Building a successful online marketplace is challenging enough, but doing so without traditional insurance? That’s a whole different ball game. Yet, many platforms are choosing this path, and it’s not just a matter of cutting costs — it’s about designing a business model that cleverly shifts liability away from the platform itself.

At Dittofi, we’ve worked with countless entrepreneurs and marketplace founders who want to build thriving platforms without breaking the bank on costly insurance policies. We’ve seen first-hand how effective strategies like third-party indemnification, escrow systems, and robust trust & safety policies can protect platforms from legal and financial exposure. With our experience in developing and scaling digital marketplaces, we understand the intricate balance between innovation, compliance, and risk management.

From SaaS marketplaces and creative content hubs to peer-to-peer platforms, the decision to avoid insurance isn’t as reckless as it might sound. Instead, it’s often part of a carefully crafted strategy where liability is pushed onto sellers, creators, or service providers. However, this approach comes with its own set of challenges, and managing them effectively is crucial to ensuring platform sustainability and user trust.

So, how do these marketplaces keep themselves protected? And what risk management strategies can you implement if you choose to operate without insurance? Let’s break it down, drawing from our own experience helping founders build secure, scalable platforms.

Why Some Marketplaces Avoid Traditional Insurance

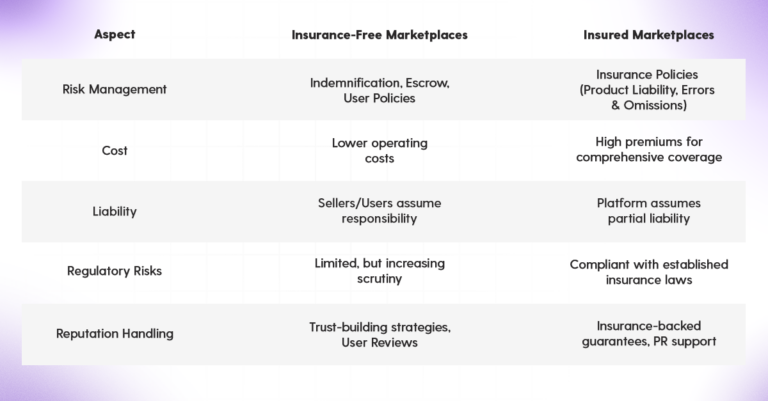

If you’re thinking about launching a marketplace or already running one, you might wonder why some platforms decide to skip traditional insurance altogether. The answer often boils down to cost, complexity, and clever liability-shifting tactics.

Insurance premiums for digital platforms can be extraordinarily high, particularly when dealing with a large number of independent sellers or service providers. Additionally, marketplaces that act as facilitators rather than direct sellers often argue that they shouldn’t be responsible for what happens between two independent parties using their platform.

Instead of paying hefty insurance premiums, many platforms find ways to shift liability away from themselves. One of the most common strategies is to legally designate sellers as the Vendor of Record (VoR) — meaning they are the ones legally responsible for what happens during a transaction, not the platform itself.

Take Etsy, for example. While the platform offers tools and infrastructure to sellers, it makes it crystal clear that sellers are responsible for their own products, customer interactions, and legal compliance. Similarly, platforms like Patreon and OnlyFans clearly state in their terms of service that creators are independent business operators, not employees or representatives of the platform.

But if marketplaces aren’t relying on insurance, what exactly are they doing to stay protected?

Understanding Marketplace Risk Exposure Without Insurance

Going insurance-free doesn’t mean you’re free from risk. In fact, it means you need to be proactively managing and mitigating potential threats every step of the way. Marketplaces that operate without traditional insurance are often exposed to a range of risks, including:

- Legal Liability: Disputes between buyers and sellers can turn ugly, especially if someone believes the platform should step in and resolve the issue.

- Financial Loss: Without insurance, the platform itself could be financially liable for certain disputes if it doesn’t have adequate protection mechanisms in place.

- Fraud & Scams: Platforms that enable peer-to-peer transactions are particularly vulnerable to fraudulent activity.

- Reputational Damage: A single high-profile incident can destroy a marketplace’s credibility, especially if it’s accused of not doing enough to protect its users.

To navigate these challenges, marketplaces must employ sophisticated risk management techniques. And no, it’s not just about having good lawyers — it’s about designing systems and structures that actively reduce the likelihood of disputes and mitigate damage when things do go wrong.

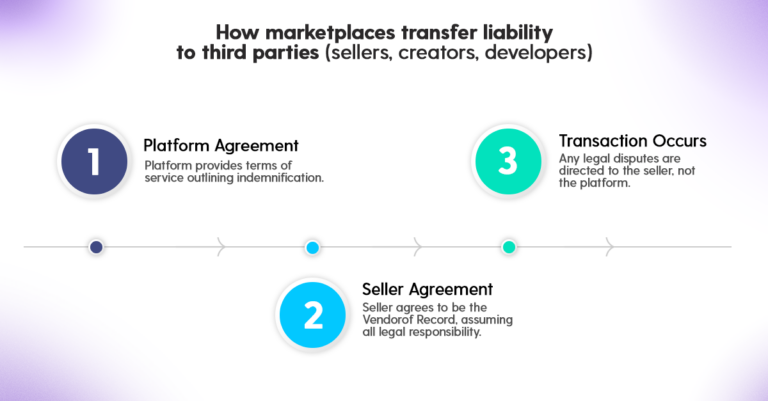

Third-Party Indemnification: Shifting Liability Away From the Platform

One of the most popular strategies used by marketplaces to avoid liability is third-party indemnification. But what does that really mean?

In simple terms, indemnification is a legal agreement where one party agrees to cover the losses or damages suffered by another. In the case of online marketplaces, platforms often include indemnification clauses in their Terms of Service agreements, requiring sellers or service providers to assume responsibility for any legal disputes or financial claims that arise from their transactions.

For instance, if you run a SaaS marketplace, your Terms of Service might state that app developers are responsible for ensuring their software complies with legal regulations and doesn’t infringe on third-party rights. If a lawsuit emerges, the developer — not the platform — is expected to handle it.

This approach is especially effective when combined with strong legal disclaimers that clearly outline the platform’s limited role. The more clearly you communicate that the platform is merely a facilitator, the better your chances of successfully shifting liability.

But of course, third-party indemnification has its limits. If the seller doesn’t have the financial resources to back their promises, you could still find yourself facing legal trouble. That’s why it’s essential to combine indemnification with other risk management tactics to build a more comprehensive safety net.

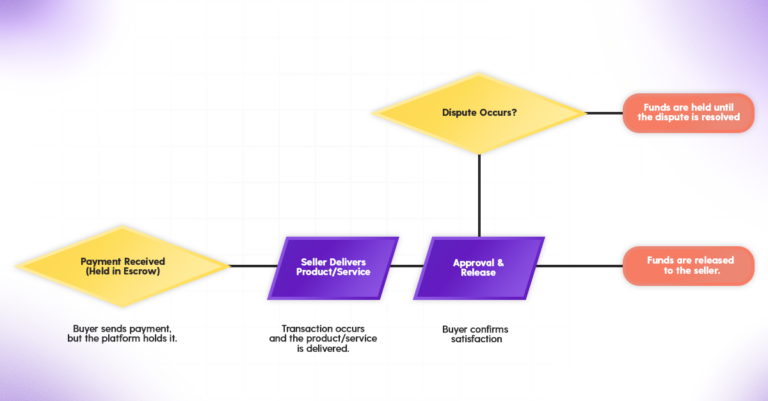

Escrow and Payment Holds: Financial Risk Mitigation

While indemnification is primarily a legal strategy, escrow services and payment holds are powerful financial tools that help marketplaces mitigate risk without relying on insurance.

Here’s how it works: Instead of allowing sellers to receive payment immediately upon a transaction, the platform holds the funds in escrow until certain conditions are met. This might include buyer approval, successful delivery, or meeting predefined quality standards.

For example, Upwork uses an escrow system to ensure freelancers only get paid when clients are satisfied with the completed work. This approach not only reduces the likelihood of disputes but also builds trust among users, a crucial element when you’re not providing insurance-backed guarantees.

Similarly, Freelancer.com implements milestone payments where funds are released only when specific project stages are completed. It’s a win-win: buyers feel secure, and sellers are motivated to deliver quality work.

Escrow systems are particularly useful for platforms where large sums of money are exchanged, or where transactions are complex enough to require multiple stages of approval.

But what about platforms that can’t — or don’t want to — use escrow? That’s where building user trust becomes the next best line of defense.

Trust & Safety Policies: Building Platform Credibility

When you’re running a marketplace without insurance, trust becomes your most valuable currency. After all, if your users don’t feel safe using your platform, they’ll find one that does. That’s why many successful marketplaces pour substantial effort into creating robust trust and safety policies that act as a de facto insurance policy, even if they’re not officially called that.

A lot of this boils down to how well you establish clear, enforceable guidelines for everyone using your platform. The goal? To promote good behavior, prevent abuse, and quickly resolve disputes before they escalate.

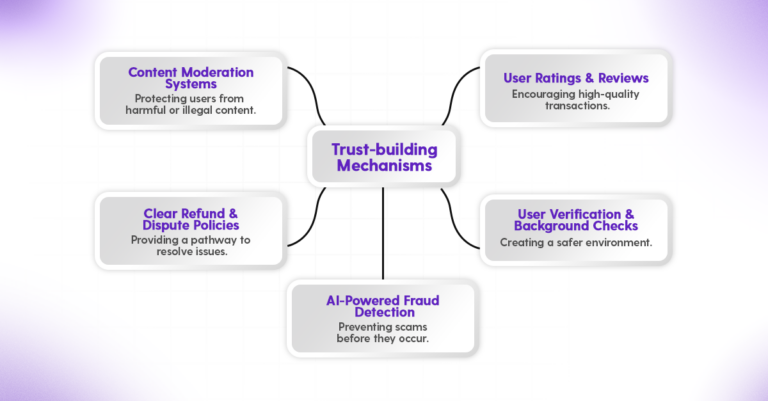

How Marketplaces Build Trust Without Insurance:

- User Verification & Background Checks:

Platforms like Airbnb and TaskRabbit use identity verification tools to ensure users are who they say they are. This step alone can significantly reduce instances of fraud and create a safer environment for transactions. - Transparent User Ratings & Reviews:

User-generated ratings and reviews are incredibly powerful. By allowing buyers and sellers to rate each other and leave feedback, platforms can naturally weed out bad actors and reward trustworthy participants. It’s a self-regulating ecosystem that helps build credibility over time. - Content Moderation & Monitoring:

Particularly for platforms that host digital content (like Patreon or OnlyFans), having strict moderation policies is crucial. Automated systems can detect violations of terms of service, while manual moderation can handle more nuanced cases. - Clear Refund & Dispute Policies:

Even if you’re not offering insurance, having well-defined policies for refunds, returns, and dispute resolution can go a long way toward earning user trust. Platforms like Etsy offer Buyer Protection Programs that resolve disputes without ever taking on direct liability themselves. - AI-Powered Fraud Detection:

With online fraud being an ever-present threat, many platforms invest heavily in AI-driven systems that identify and block suspicious transactions before they become a problem. From verifying payment details to monitoring behavioral patterns, AI can help keep your marketplace safe without the need for formal insurance

Ultimately, all these mechanisms work together to create a sense of security and reliability, which helps marketplaces flourish even in the absence of traditional insurance. But what happens when disputes arise that can’t be solved by your shiny new safety policies? That’s where formal dispute resolution systems come into play.

Implementing Effective Dispute Resolution Systems

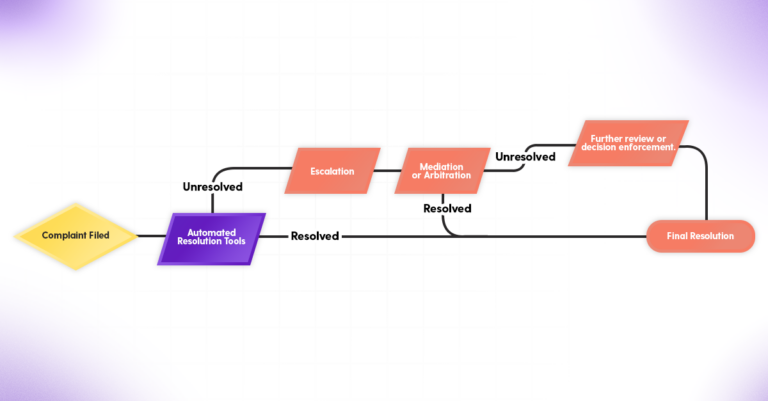

No matter how robust your indemnification clauses or trust policies are, disputes are going to happen. The real question is: How well-prepared are you to handle them?

Having a strong dispute resolution system can make all the difference between happy users and costly legal battles. The best part? You can establish effective systems without relying on insurance to cover your back.

Building a Reliable Dispute Resolution System:

- Arbitration & Mediation:

Instead of letting disputes escalate to lawsuits, many marketplaces incorporate arbitration clauses into their Terms of Service. Arbitration is a private process where an impartial party makes a binding decision, often much faster and cheaper than going to court.

Mediation, on the other hand, involves a neutral third party helping users reach a mutually agreeable solution. This approach is often preferred when platforms want to avoid the appearance of taking sides. - Automated Dispute Resolution Tools:

For smaller, everyday disputes, automation can be a lifesaver. Platforms like eBay use automated systems to handle common complaints like refund requests or item misrepresentation, providing a streamlined process that keeps issues from clogging up support channels. - User-Friendly Resolution Portals:

Creating a dedicated interface where users can easily file complaints, submit evidence, and track progress is a game-changer. The more transparent and user-friendly your process is, the more likely users are to feel their issues are taken seriously. - Standardized Resolution Protocols:

Having clear guidelines for how disputes are handled not only speeds up the process but also prevents accusations of unfairness or bias. Transparency here is essential for maintaining user trust.

By offering users a straightforward way to resolve disputes, you’re giving them the confidence to use your platform even when insurance-backed guarantees aren’t part of the package. But dispute resolution is only part of the puzzle. Keeping your marketplace safe requires ongoing monitoring and adaptation.

Want to dive deeper into marketplace insurance requirements? Check out this comprehensive guide on whether marketplaces need insurance.

Risk Monitoring & Adaptation: Staying Ahead of Legal Challenges

Here’s the hard truth: The legal landscape for online marketplaces is constantly evolving. What worked yesterday may not work tomorrow. So, if you’re trying to avoid insurance costs while protecting your platform, you need to continuously monitor potential risks and adapt your policies accordingly.

For instance, new consumer protection laws in the EU or California’s AB5 law can suddenly turn what was once a legally sound business model into a lawsuit magnet. And if your platform isn’t prepared to adapt, the consequences can be catastrophic.

How to Stay Ahead of the Curve:

- Regularly Review Your Terms of Service: Laws change, and so should your legal agreements. Regularly updating your Terms of Service to reflect new legal realities is crucial.

- Conduct Periodic Risk Audits: Assess your marketplace’s vulnerabilities from both legal and operational perspectives. Identify weak spots before they become problems.

- Keep an Eye on Competitors: If another platform is being targeted by regulators or sued for liability issues, take that as a valuable warning sign.

- Collaborate with Legal Experts: You don’t have to do this alone. Regular consultations with legal professionals can help you navigate potential pitfalls.

- Adapt Your Platform Structure: If regulations are making it harder to maintain your liability-free status, consider modifying your business model to better align with legal requirements.

In short, marketplaces that actively monitor their risk landscape and adapt to changing conditions are the ones that will survive and thrive. But what if you’re still not sure whether going insurance-free is the right choice?

Balancing Cost & Protection: Should You Get Insurance After All?

Alright, so you’ve made it this far. By now, you’ve probably realized there’s no one-size-fits-all solution for marketplace risk management. Going insurance-free has its perks: it’s cost-effective, flexible, and allows you to keep your platform legally streamlined. But here’s the catch: it’s not always the safest bet.

At some point, every marketplace founder needs to ask: Is it really worth the risk?

Insurance may be expensive, but sometimes, it’s simply a smart investment — especially when your marketplace operates in higher-risk areas. For instance, if your platform deals with high-value transactions, like luxury goods or premium services, a single lawsuit could spell disaster. The financial blow from just one legal battle could wipe out your profits and tarnish your reputation overnight.

Then, there’s the issue of sensitive user data. In today’s world, data breaches aren’t just an IT problem; they’re a legal nightmare waiting to happen. If your marketplace collects or stores customer information, a security breach could leave you facing costly liability lawsuits that could have been avoided with the right insurance coverage.

And let’s not forget about platforms that involve physical services. Companies like Airbnb have learned the hard way that sometimes, offering insurance coverage is the only way to protect their reputation and keep their user base intact. When guests trash properties or worse, the platform needs to step up — or risk losing user trust altogether.

The bottom line? While there are ways to reduce liability without insurance, sometimes a policy tailored to your marketplace’s specific risks is worth the peace of mind it brings. But even if you decide to invest in insurance, it should be just one piece of your overall risk management strategy, not the entire solution.

So, when should you consider getting insurance? It depends on your business model, risk tolerance, and growth ambitions. If you’re scaling rapidly or expanding into regions with strict regulations, insurance might be a smart addition to your toolkit.

But even if you choose to get insurance, that doesn’t mean you should abandon the risk management strategies we’ve discussed. Think of insurance as your last line of defense, not your primary strategy.

Wouldn’t it be better to design a platform that prevents disputes and reduces liability from the start rather than relying on insurance to clean up the mess afterward?

Key Takeaways for Marketplace Founders

Running a marketplace without insurance is absolutely possible. Many platforms have proven that with the right strategies, you can mitigate risk effectively without burdening your business with sky-high insurance premiums.

Here’s a quick recap of the most effective risk management strategies for marketplaces without insurance:

– Third-Party Indemnification: Use strong indemnification clauses to transfer liability to sellers, service providers, or creators.

– Escrow & Payment Holds: Implement payment security mechanisms to ensure transactions are completed successfully before funds are released.

– Trust & Safety Policies: Build credibility with transparent user guidelines, fraud detection systems, and effective content moderation.

– Dispute Resolution Systems: Establish clear, efficient processes for handling complaints and disputes to minimize legal exposure.

– Continuous Risk Monitoring: Regularly review your policies and adapt to changing legal landscapes to avoid costly surprises.

Insurance-free marketplaces can absolutely thrive — if they plan ahead and continuously refine their risk management practices.

Final Thoughts: Navigating the Insurance-Free Path

If you’re building a marketplace and trying to avoid insurance costs, the key is to be proactive, not reactive. Having robust systems in place—whether it’s indemnification clauses, escrow systems, or automated dispute resolution—can make all the difference between success and failure.

But remember: just because your platform doesn’t carry insurance doesn’t mean you can afford to be careless. Smart marketplace founders understand that risk management is a continuous process, and the most successful platforms are the ones that stay adaptable and ahead of the curve.

The big takeaway? Insurance isn’t always necessary, but effective risk management is. Make sure your marketplace is built to thrive, regardless of what the legal landscape throws your way.

Protect Your Marketplace Without Insurance

Build a platform that’s legally secure and built to last. Discover how to manage risk the smart way.