Take Rate Definition

In the context of online marketplaces, the take rate, or commission, is the transaction fee that marketplaces (such as Amazon or eBay) charge for facilitating transactions between buyers and sellers.

The take rate is also commonly referred to as “rake”, “commission,” “fee,” or “transaction fee”.

Marketplaces are all about translation volume.

This is why the Gross Merchandise Volume (or GMV) is often used as a one of the primary marketplace metrics to monitor marketplace performance.

Although it might sound counter intuitive, getting to a healthy and growing GMV is (in part) a function of your marketplace take rate (or commissions) strategy.

In this article we will take look at exactly why that is. We will cover:

- What is the take rate (or commission)

- Examples of marketplace take rate strategies

- Putting take rate in context

- What impacts the marketplace take rate

- What is the average marketplace take rate

- How to find the right take rate for your marketplace

- How to calculate take rate

Let’s kick off by looking at what the take rate is and, some example take rates.

What is the take rate?

In the context of online marketplaces, the take rate (or commission) is the percentage of the sale that the marketplace charges for facilitating a transaction between a buyer and seller.

For example, imagine that you run a marketplace similar to Airbnb where travellers book vacation rentals. If travellers spend a total of $100,000 on bookings through your marketplace, and you charge a 10% commission, your take rate is 10%. This means you earn $10,000 in revenue from those bookings.

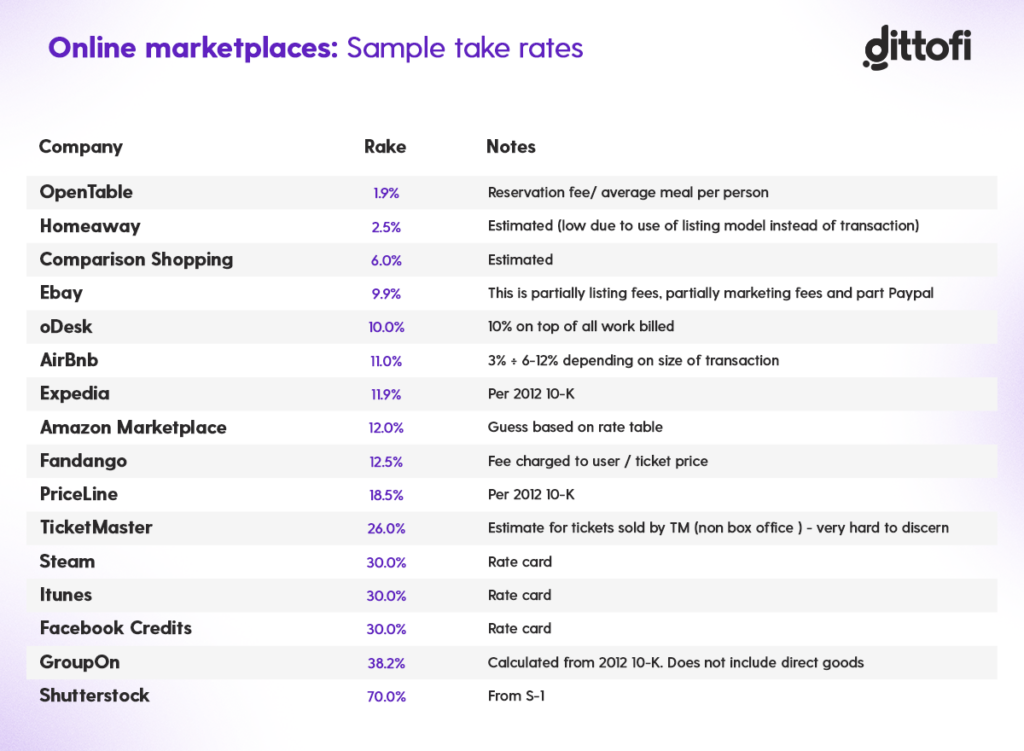

Take rates charged by marketplaces vary based on a range of factors. The table below shows the take rates for 16 of the most popular online marketplace businesses.

Note, some of these rates are estimated based on a percentage of marketplace GMV or are averages of more complex rate tables. For example, take rates at Amazon are different for each product category.

Marketplace founder tip

If you are new to marketplace development, you will likely not have the resources required to build a complex take rate strategy.

As a result of resource constraints, it is almost always best to start by focusing on one marketplace niche e.g. Amazon started by focusing on one single category, books.

Over time, you will add in more categories and you start to scale up your marketplace. At this stage marketplaces often hire category managers who will focus on building a strategy for one particular category of products or services.

Example of marketplace take rates

If you look at the table in the previous section, you will see marketplace take rates vary a lot.

On one end of the spectrum there is Shutterstock which charges an astonishingly high 70% rate vs OpenTable which charges 1.9% rate. In this section, we will take a look at the pricing strategies behind these different marketplace take rates.

Airbnb’s take rate: Presentation matters

Airbnb knows that price conscious travellers price compare. These travellers will book their vacations on platforms that offer the lowest cost and equivalent experience. Therefore, it is no surprise that Airbnb’s original tagline was “a cheap, affordable alternative to a hotel”.

In 2024 Airbnb reported that its global average daily rate in March for a one-bedroom was $114, while CoStar reported that the equivalent rate for a hotel room was $140.16. So – Airbnb is clearly a more budget friendly option. However, this has not always been the case.

In 2023, Airbnb’s marketplace was presented with a unique problem. Post IPO, their investors demanded higher revenues but, at the same time, Airbnb’s guests were complaining about high prices on their platform. As the complaints came in, bookings started to fall. As booking fell, Airbnb was losing revenue to more price competitive alternatives. Why were Airbnb’s prices so high, if revenue was so low? The answer lies in how Airbnb presented their take rate and cleaning fees.

Airbnb change the way they present their listing prices

After analyzing their pricing strategy, Airbnb’s management team realized that high prices were caused by a combination of:

- Airbnb’s take rate;

- High cleaning fees set by hosts.

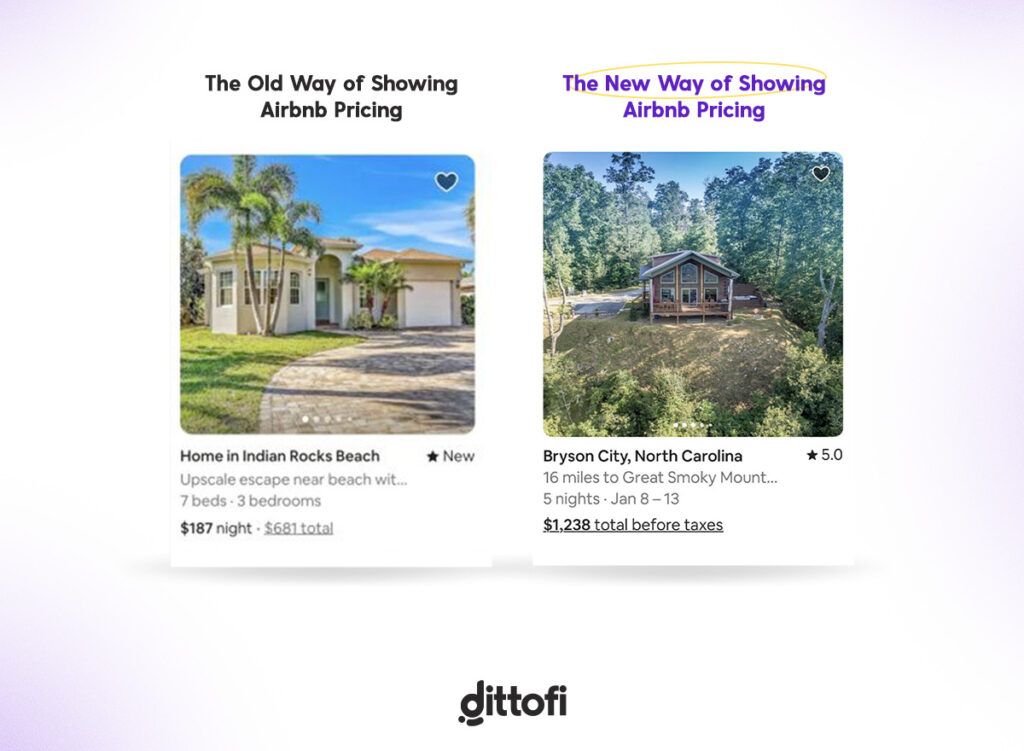

At the time, Airbnb presented their marketplace listing prices without the cleaning fee or take rate. These fees were only added at checkout, after the guest had chosen a property to stay at.

Hosts used this method of price presentation to set artificially low prices on their listing pages. The low prices displayed allowed hosts to get their listings into the guests search results. The same hosts would then present excessively high cleaning fees only at checkout after the guest had chosen their property. The cleaning fees were set artificially high so as to cover the hosts own costs of actually renting out their property. This pricing strategy was causing Airbnb to see high cart abandonment rates from guests at checkout.

To counteract this, Airbnb rolled their take rate and cleaning fees into the total price that was displayed on their marketplace listing and map views. This forced hosts to offer lower cleaning fees in order to get into the guests search results. Airbnb thus created an incentive for hosts to offer lower total listing prices, factoring in both cleaning and Airbnb’s take rate. A screenshot of this price display is shown below.

With this new listing display method, Airbnb was able to increase the number of bookings on their platform whilst simultaneously raising their own take rate. Airbnb’s revenue per booking increased, listing prices went down, number of bookings went up, investors were happy!

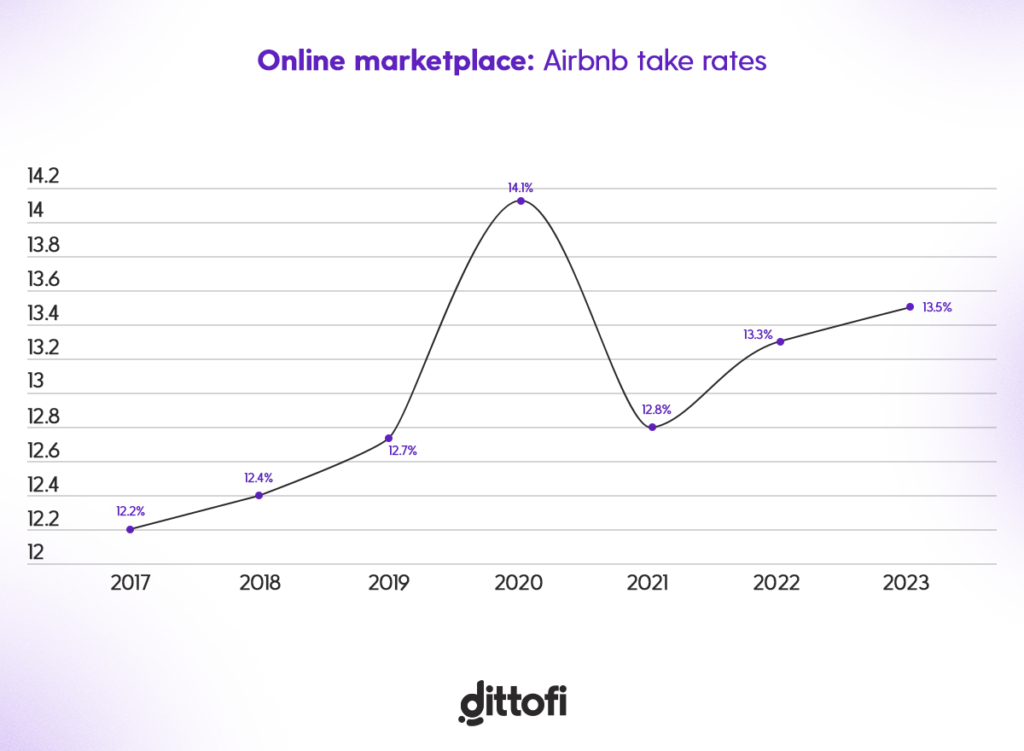

You can also see below how Airbnb’s take rate has changed over time. From 2022 to 2023 you can see that Airbnb was able to actually increase their take rate while reducing the cost for guests using their platform.

In 2024, Airbnb charges hosts 3% of their booking value to list on their platform whereas guests are charged between 0% – 20% of the total booking value.

Learn how to use Dittofi to build a marketplace like Airbnb in less than 24 hours and without coding.

Ebay vs Amazon, how to attack your competitors with low take rates

Amazon has different take rates for different categories of products. These range from 6% for personal computers to 20% on certain types of Jewellery.

In 2013, eBay decided to attack Amazon by offering lower commissions compared to Amazon. They did this on a per category basis. A screenshot of the price comparisons between Amazon and eBay is shown below. The goal of having lower take rates on comparative products was to make eBay’s marketplace price competitive with Amazon.

Shutterstock use high take rates to create incentives

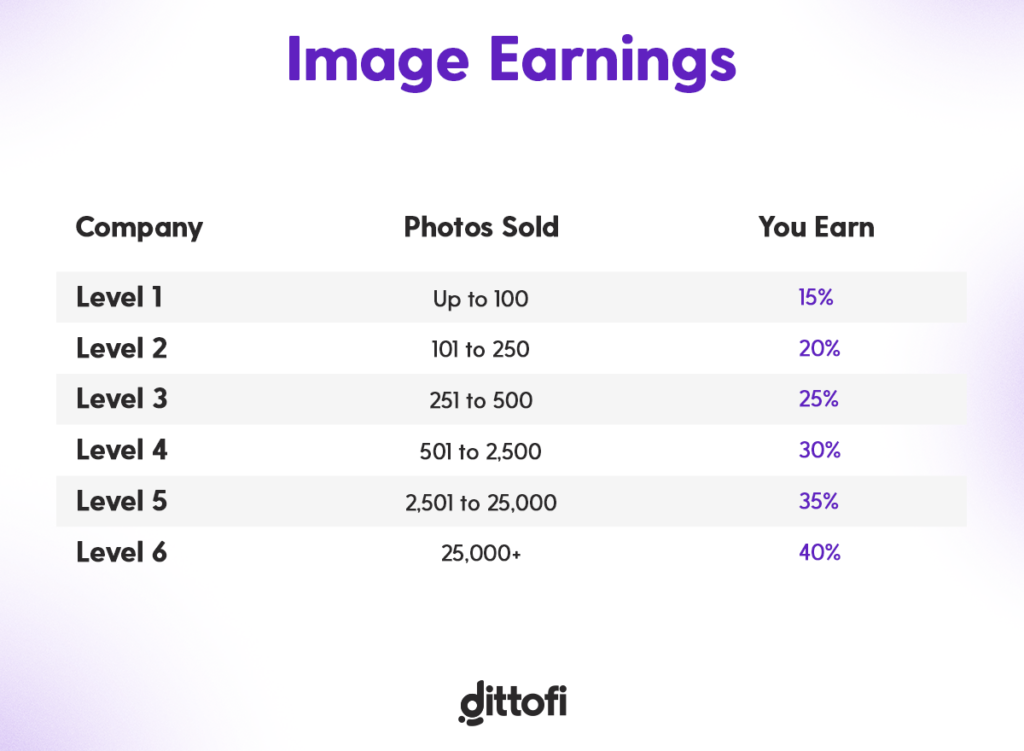

The photo sharing marketplace Shutterstock has a shockingly high take rate compared to other marketplaces on our list. The creators who post and sell photos and videos on Shutterstock earn between 15% and 40% of the sale value.

Shutterstock categorize their creators into different levels. Creators who sell more earn more. This incentivizes seller to keep listing and selling products.

Based on their S1 report, the average Shutterstock take rate is 70%, meaning that on average creators only keep 30% of what is sold on Shutterstock. This high take rate could create an opportunity for competitors to offer better pricing for these types of digital asset.

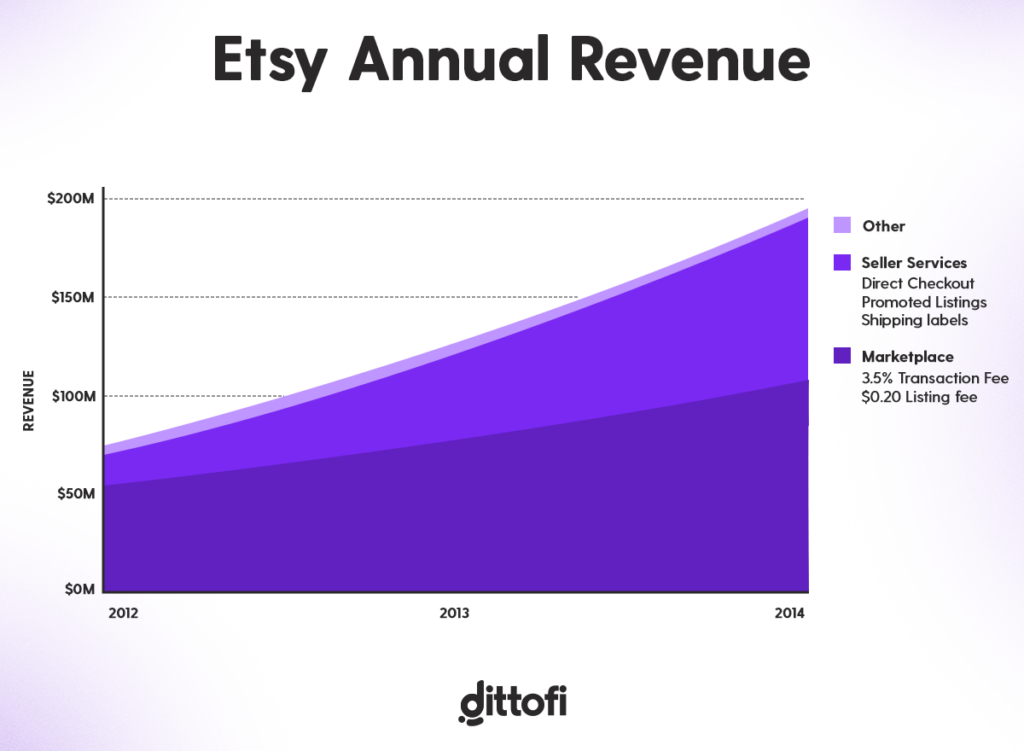

Etsy lower take rates to increase revenue

In 2015, Etsy’s S1 revealed that they had strategically lowered their take rate, but still managed to increase their revenues. Etsy did this by creating a suite software tools designed to support their most active sellers in growing their businesses. These tools were sold on a subscription and their revenue and, as shown in the S1 report, became the dominant revenue stream on their marketplace. This is highlighted in the chart below.

Whilst the average Etsy seller is not interested in these software tools, those who are are willing to pay a premium for them. This premium has allowed Etsy to reduce their marketplace take rate whilst simultaneously increasing their revenue. By doing this, Etsy has made it harder for competitors to build similar marketplace websites since, they are able to offer their buyers and sellers lower platform fees than their competition.

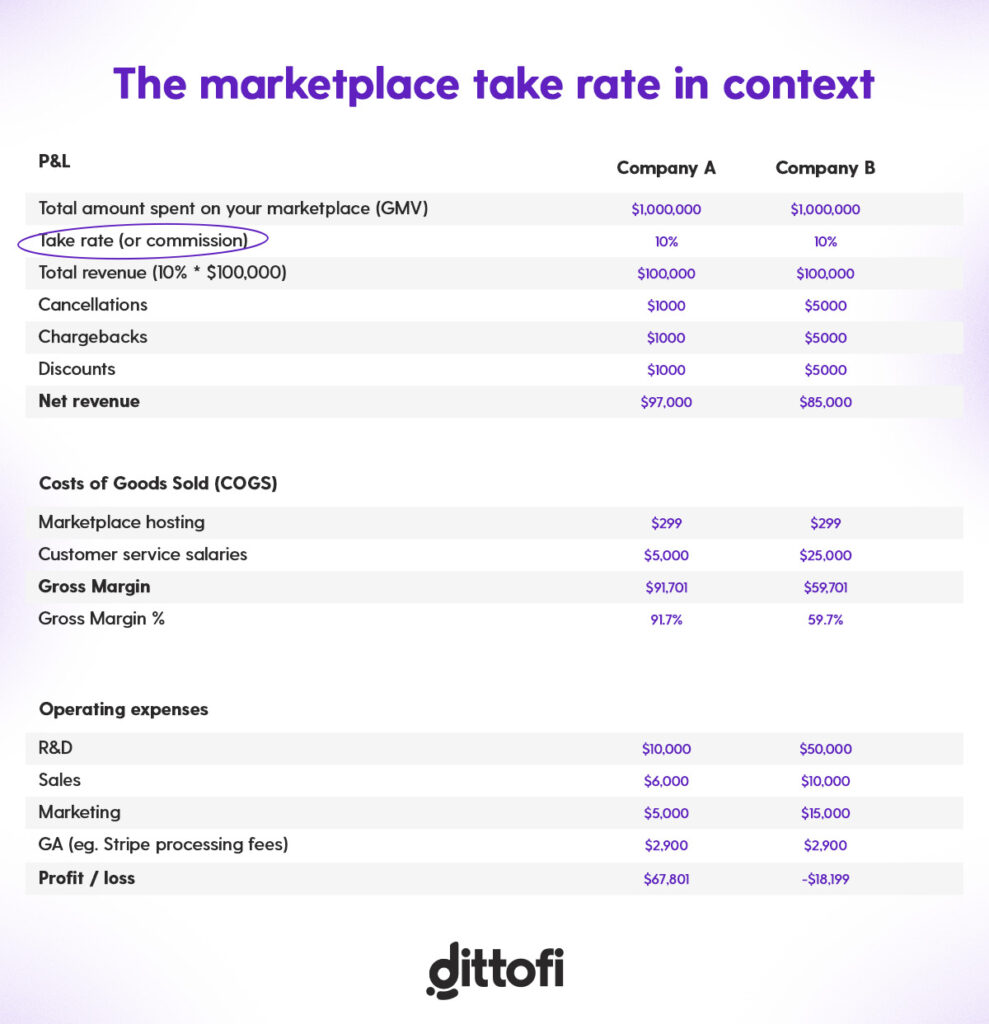

Putting the take rate in context

The take rate is an important number that helps to determine how much revenue your marketplace business will make. However, outside the context of your business, it doesn’t mean anything. To see how the take rate impacts your business, let’s take a look at the following very simple example.

Imagine you run a marketplace similar to Uber, where passengers book rides. If passengers spend a total of $1,000,000 on bookings through your marketplace, and you charge a 10% commission, your take rate is 10%. This means you earn $100,000 in revenue from those bookings.

In our simple example above, you can see that the marketplace revenue is a function of two things:

- The total amount spent on rides i.e. $1,000,000. This is also known as the Gross Merchandise Volume (GMV)

- The take rate, or 10% commission that is charged

Your marketplace revenue is NOT your marketplace profit. In fact the revenue is only the money that you make after taking account of cancellations, chargebacks and discounts and before taking into account the fixed costs of running your marketplace and the variable costs of fulfilling each transaction.

The tables below show the profit and loss for two businesses with the same GMV, the same take rate, cancellations, chargebacks and discounts. This ends up giving both businesses the same net revenue. However, the business on the right has substantial higher variable costs, leading to a loss.

As you can see from the table above, both companies are making the same GMV and have the same take rate of 10% which yields a $100,000 revenue. However, scanning down to the bottom of the table, you can see that the company on the left is making a profit of $67,801 and the company on the right is making a loss of $18,199.

To make the business on the right profitable, you would need to either increase the take rate to say 15% which will boost the revenue. Alternatively, you will need to make cutbacks on other areas of the business.

Raising the take rate might seem like the obvious move however, it is a dangerous move and will raise a red flag that your competitors will see and look to exploit. As Jeff Bezos, founder of Amazon is fond of saying, “your margin is my opportunity”. Therefore, it may be good to increase your take rate or it might be better to look for ways to cut costs – for instance you could look at ways to optimize your customer support.

Each marketplace situation is different. Some can charge higher prices, others naturally operate on thinner margins. As marketplace investor Bill Gurely says, “high [transaction] volume combined with a modest rake is the perfect formula for a true organic marketplace and a sustainable competitive advantage”.

“High [transaction] volume combined with a modest rake is the perfect formula for a true organic marketplace and a sustainable competitive advantage.”

– Bill Gurley, General Partner at Benchmark

Let’s take a look at what actually impacts the marketplace take rate and how to find a take rate that works for you.

What factors influence marketplace take rate

If you set your marketplace take rate excessively high, this will make the price of transacting on your marketplace unnaturally high relative to anything that takes place off your marketplace. This forces potential buyers to look elsewhere for more competitive pricing.

Nowhere is this more apparent than in the travel industry where price sensitive travellers use price comparison software to compare prices for trips, tours, flights and stays, across multiple marketplace platforms including Booking.com, Expedia, Hotels.com and so on. Would you pay 10% more to book your hotel through Expedia compared to Booking.com? Probably not.

So we know that high take rates are dangerous, but your marketplace needs to make money. So how do you come up with a take rate that works for everyone? The answer to this question is found in the following drivers for marketplace commissions.

Levels of competition

As we have seen, if you operate in a competitive market with price conscious consumers, you may consider a low take rate. This is because a high take rate can force your product or service listings to be unnaturally high and therefore force consumers to look elsewhere for alternatives.

Conversely, if your market is not competitive, you may consider a higher take rate in order to maximize your revenues. However, this should not be too high for too long, otherwise it can create opportunities for competitors to enter your marketplace.

Demand and supply differentiation

Many marketplaces charge buyers and sellers different rates depending on how frequently they transact on the marketplace. We saw this earlier with Shutterstock who allow their creators to take a larger cut of each sale once they transact above a certain volume. By differentiating take rates in this way, marketplaces can create incentives for buyers and sellers to transact more.

Marketplaces might also consider differentiating take rates according to product or service categories. If a certain category is more in demand this can be an opportunity to increase the take rate. Whereas, if the product or service is oversupplied, then the take rate can be lowered.

Marginal costs

Marginal cost for suppliers is the cost of producing one more unit of a good or service.

For example, let’s suppose that you have a marketplace that connects freelance Spanish teachers with students in the local area. In this case the marginal cost for the teacher might include the cost of travelling to the students home, flash cards, notepads or other costs that are incurred in teaching the student. If the teacher adds all of these costs up, the marginal costs might be $10 per 1 hour class.

If the teacher charges $30 per 1 hour class and the marketplace take rate is 30%, this means the teacher only gets to keep $14 per 1 hour class. This may not be attractive enough to capture a good supply of quality teachers. However, if the marketplace reduces their take rate to 10%, the teacher will now take home $18 per 1 hour which may capture a better supply of quality cleaners.

Of course, most marketplaces would also give the option for the suppliers to set the price for their product or service which, in our example, would increase the teacher take home. However, if suppliers are forced to set higher prices for their products or services because of high marginal costs and marketplace take rates this can cause a reduction in overall platform bookings. Marketplaces cannot easily control their suppliers marginal costs and so it is probably easiest to just lower the take rate.

Network effects

Marketplace network effects occur when the value users derive from the marketplace increase with the number of users, both service providers and customers.

There are different types of network effects however, the one we are referring to here is the two sided marketplace network effect which is characterized by having two types of participants, buyers and sellers.

Marketplace network effects occur when the value users derive from the marketplace increase with the number of users, both service providers and customers.

There are different types of network effects however, the one we are referring to here is the two sided marketplace network effect which is characterized by having two types of participants: buyers and sellers.

In a garage sale, the value increases as more buyers and sellers participate. If only one person is selling items, the variety is limited and may not attract many buyers. Conversely, if only one buyer shows up, sellers might not find it worth their time. However, as more sellers join, offering a diverse range of items, it attracts more buyers looking for bargains and unique finds. This, in turn, encourages even more sellers to participate, knowing they will have a larger audience. The increased activity creates a positive feedback loop where the presence of more participants on both sides of the marketplace amplifies the value for everyone involved, exemplifying the network effect.

Marketplaces with a high network effect can afford to have higher take rates. Conversely, for marketplaces just starting out, you might want to begin with a low or even no take rate just to get the first buyers and sellers onto your marketplace.

Market heterogeneity

A highly fragmented market has many small players with no one dominant product or service provider. In fragmented markets, competition is intense, and businesses often focus on local or niche markets. This results in a diverse set of products or services catering to local or niche demand.

With diverse product or service offerings, large firms have the chance to enter and consolidate by offering standardized services, gaining a competitive edge through economies of scale.

Marketplaces also have opportunities in such markets, but matchmaking between sellers and buyers can be challenging because of the diverse range of products or services. As a result, marketplaces operating in fragmented markets can charge higher fees because they facilitate more complex transactions compared to those operating in concentrated markets.

Conclusion: it's about value and strategy

As we have see, marketplace take rate is dependent on a number of factors. What it eventually boils down to is that the take rate is a function of what the market is willing to pay, and the nature of your marketplace.

If you do more for your buyers and sellers you can charge more. However, as we learnt in the previous section, having a wider view on the strategy behind your take rate is also very important.

In the next section we look at what is the average marketplace take rate and consider why it may be better to benchmark yourself against take rates within your niche.

What is the average marketplace take rate?

The average marketplace take rate is between 10% and 30%. However, marketplace take rates range from from as little as 0% to as high as 95%. Therefore, if you’re looking to benchmark your take rate, it’s better to study take rates in your particular niche.

For example, if you’re building a marketplace for tour guides, look at the rates charged by platforms such as Expedia, Airbnb Trips and other online travel marketplaces. In contrast, if you’re building a marketplace for AI service providers, you might consider benchmarking yourself against freelancer platforms such as Fiverr or Upwork.

Let’s take a look at one way you can find the right take rate for your marketplace.

How to find the right take rate for your marketplace

There are a few different ways to find the right take rate for your marketpalce.

Essentially you need to decide who you are going to charge i.e. the buyer, the seller or both, how to charge i.e. fixed or percentage, how much to charge and how to present the charge to your marketplace users.

In this section, we break down each of these considerations and look at some methods that you can use to find the right take rate for your marketplace.

Who to charge?

On your marketplace, there will be two sides to every transaction: buyers and sellers. As the marketplace operator, you can choose to charge commission to the buyer, the seller or split the commission between them.

Although the marketplace will get the same amount out of each transaction, there are several reasons why it’s important to consider which side you charge commission on. This includes

- Optics – many marketplace creators will look to optimize their buyers workflow and customer experience. They therefore choose to present the price of a product without breaking out the platform fee. Think back to our example of how Airbnb updated their presentation of the the listing prices to their renters.

- Regulations – certain regions have laws about how prices on marketplaces are presented. For instance, the EU Directive on Consumer Rights includes several provisions that effect how online marketplaces are required to disclose fees.

- Tax considerations – Since 2021, online marketplaces operating in the EU are required to collect and remit VAT on certain transactions involving sellers from outside the EU. This regulation ensures that VAT is collected at the point of sale and is reflected in the price shown to the buyer, affecting both the final price and the fees the marketplace may charge.

How to charge, fixed vs percentage take rate?

The take rate can either be a:

- Fixed amount

- Percentage of the total transaction value

- Combination of fixed cost plus a percentage of transaction value

Fixed amounts are simple and predictable. They can appeal to buyers and sellers conducting high value transactions, since they don’t scale with the transaction value. In contrast, percentage fees are more scalable for the marketplace than fixed fees, however they may prejudice high value transactions.

Lastly, a combination of fixed cost plus a percentage of transaction value can optimize revenue for low ticket sales. Meanwhile some marketplaces choose to charge a percentage for low value transactions and put a maximum fixed cap on commissions above a certain threshold. This helps ensure that high ticket transactions are still done on the marketplace.

How much should your take rate actually be?

As we’ve already discussed the take rate is impacted by 7 main factors: levels of competition, demand and supply differentiation, marginal costs, network effects, market heterogeneity, value add and strategy.

To find the the right take rate for your marketplace it is a matter of testing different scenarios with your marketplace users. Normally new marketplaces will charge a low or no commission at all. This removes any friction in the transaction process and allows them to start onboarding users.

Two important points to bear in mind when choosing an initial take rate for a new marketplace, product or service category include:

- To build a dominant marketplace, take as little as you need. If your objective is to build a dominant marketplace over a very long term, you want to build a platform that has the least amount of friction as possible. High take rates are a form of friction because they increase the price for the consumer. If you charge an excessively high take rates, the price of items in your marketplace will be high relative to anything outside your marketplace. However, if your aim is to be the “definitive” place to transact, you will need industry leading pricing – which is impossible if your take rate is the de facto cause of excessively high pricing. High rakes also drive buyers and sellers to look elsewhere, which endangers sustainability.

- You can change your pricing model later. Your marketplace take rate is not a fixed component. As we saw with Airbnb, take rates often evolve naturally over time in response market feedback.

How to calculate take rate

The take rate is the percentage amount of the total transaction value that the marketplace retains, less cancellations, chargebacks and discounts.

A simple formula for calculating the take rate is:

Take Rate = (Total Revenue / Total Transaction Value) x 100

For example, if you run a marketplace that makes $100,000 in Total Transaction Value or GMV, and your marketplace keeps $10,000 this gives you the following take rate:

Take Rate = (10,000 / 100,000) x 100 = 10%

To make this number more accurate for your marketplace, you will need to remove all cancellations, chargeback and discounts from your total revenue figure.

Conclusion: Pick a rate that works for your business

Greedy short term thinking, often leads marketplace operators to establish and maintain high take rates in order to get as much money out of their users as possible.

As we have seen throughout this article, this attitude is dangerous and will not necessarily maximize marketplace profits.

This is because excessively high profit margins create opportunities for competitors to enter the market and take part (or all) of your GMV. This in turn negatively impacts your marketplace’s revenues since:

Revenue = Gross Merchandise Volume * Take Rate.

This risk is so real that it makes number 1 on Pete Drucker’s list of Five Deadly Business Sins: “worshiping profit margins and premium pricing”.

As we have seen however, each case is unique with marketplaces like Esty who are focused on lowering their take rates vs Airbnb who managed to placate investors by increasing their take rate but lowering their overall consumer costs.

As such, when picking a take rate for your marketplace, make sure you pick one that fits your market and business strategy. Don’t be afraid to start with a low rate and increase this gradually over time as you learn what additional value you can offer your users.

Importantly your take rate should reflect your stage of business and the type of transactions you’re seeing take place. For instance, if you have low transaction volume, but high value transactions, it doesn’t make sense to copy a business with low value and high transaction frequency.

As a rule, it is better to know why you’ve chosen your marketplace take rate and be able to explain this strategy to yourself, employees or potential investors.

One last bit of parting advice, don’t over engineer solutions prematurely! It is never a good idea to implement a complex take rate when you have no transactions happening.

For more information on marketplace metrics or how to build your marketplace MVP, read some more of our articles or subscribe to our marketplace insider mailing list.

Become a Marketplace Insider

Join our inner circle for exclusive insights, coveted trade secrets, and unparalleled strategies – your journey to marketplace dominance begins here.