Definition of marketplace liquidity

Marketplace liquidity can be broadly defined as “the probability of selling something you list or of finding something you are looking for”.

– James Currier, Founding partner NFX

Liquidity is the lifeblood of marketplaces.

It is the efficiency with which buyers and sellers are able to transact with each other on the marketplace.

Since marketplaces exist with the sole purpose of matching buyers and sellers, without any liquidity, marketplaces have no value. However, whilst the concept of liquidity is relatively easy to understand, it is much harder to measure. For this reason, most marketplace operators tend to focus on marketplace metrics such as cost of customer acquisition, gross merchandise value and so on.

These metrics are of course important however, being able to define, measure and interpret liquidity in a meaningful way will help you go one level deeper and understand exactly how your marketplace is performing.

In this article we will help you understand:

What is marketplace liquidity?

Marketplace liquidity can be broadly defined as the likelihood of selling something you list or finding something that you’re looking for.

There is no one single way of calculating marketplace liquidity and often it will be inferred from several marketplace specific metrics. That being said, marketplace operators and investors normally think about liquidity in two parts: buyer liquidity and seller liquidity.

What is “buyer” liquidity?

Buyer liquidity is the likelihood that a buyer’s request or search will lead to a transaction taking place.

There are several different metrics used to measure buyer liquidity. The most common is the search to fill rate (or fill ratio). This is calculated as the percentage of searches or requests that result in completed transactions.

For example on:

- Rental marketplaces like Airbnb, this is the percentage of search sessions that result in a booking.

- Service marketplaces like Upwork, this is the percentage of job postings that result in a candidate getting hired.

- Product marketplaces like Amazon, this is the percentage of search sessions that result in a purchase.

- On-demand marketplaces like Uber, this is the percentage of rides requests that result in rides.

Generally speaking, the higher the fill ratio, the better buyer liquidity is.

Knowing the fill ratio helps marketplace operators understand which side of the marketplace to focus their attention on. For instance, if buyer liquidity is low this means you need to focus on getting more or better quality sellers onto your marketplace.

What is “seller” liquidity?

Seller liquidy is the probability that a seller’s listing will be either sold or rented on a marketplace.

The best metric here is the utilization rate (or match rate). This tells us the percentage of listings that are sold or rented during a particular period.

For example on:

- Airbnb, this might be the percentage of property listings that are booked out every night.

- Amazon, this could be the proportion of stock that was available at the beginning of the month compared to the stock available at the end of the month.

- Upwork, could be the proportion of available freelancers hours that are booked out for a give period of time.

“[At Uber,] utilization is a measure of the percentage of time drivers are working versus waiting… As utilization rises, Uber can lower price, and the drivers still make the same amount.

– Bill Gurley, early stage Uber investor

To fully understand what marketplace liquidity is, marketplaces should calculate both the search to fill rate and the utilization rate on a granular basis. Although it will depend on the marketplace specifics, this could mean calculating the utilization rate per category, subcategory, geography or time basis.

Measuring marketplace liquidity on a more granular basis will yield more meaningful insights into your marketplace liquidity. For example, switching on your marketplace in a new region will naturally have lower liquidity than in a region where you’re already starting to experience network effects. If this is you, you should separate this data out so that it does not conflate with the rest of your data and skew your marketplace liquidity calculation.

How to measure marketplace liquidity

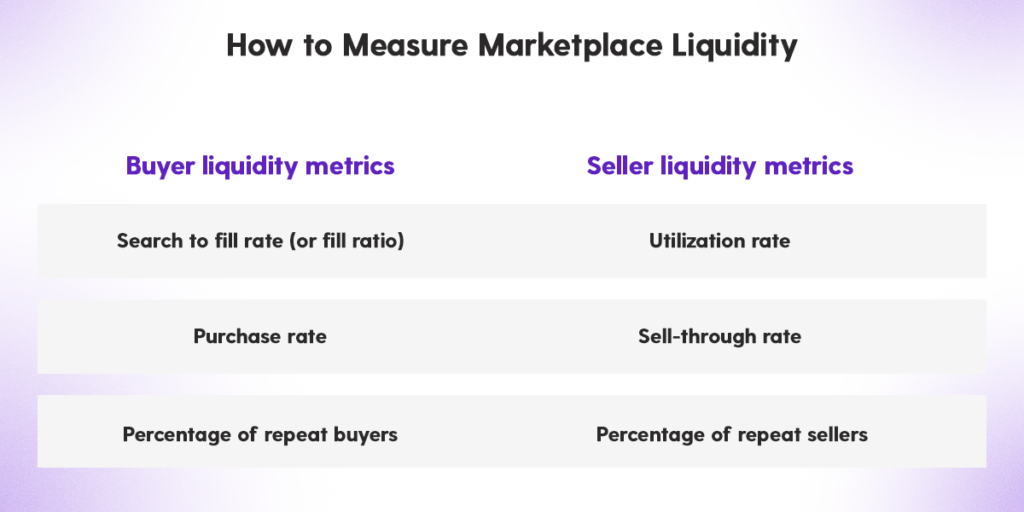

As we’ve seen, measuring marketplace liquidity depends on a number of factors. In this section we cover the most common marketplace liquidity metrics. We group these buyer liquidity metrics and seller liquidity metrics.

Let’s see how to calculate and interpret each of these metrics now.

Buyer marketplace liquidity metrics

Buyer liquidity metrics include:

To learn about seller liquidity metrics, skip to the section on Seller liquidity metrics.

Search to fill rate (or fill ratio)

We’ve already seen how to measure buyer liquidity using the search to fill rate or fill ratio. An example calculation for this could be as follows.

Let’s say that we have a rental marketplace like Airbnb or Vrbo where guests can search for and book accommodation. In a given month, you might have:

- Total number of booking requests: 5,000 booking requests made by guests.

- Number of booking requests fulfilled: Out of this 5,000 requests, you might have 3,750 who are successfully matched with available listings.

To determining the search to fill rate:

Search to fill rate = (Total number of fulfilled bookings / Total number of booking requests) * 100

Or

Search to fill rate = (3,750 / 5,000) * 100 = 75%.

In this example, we have a 75% search to fill rate which means that 25% of the people searching did not find what they wanted on the marketplace. This number suggests moderate buyer liquidity. A higher percentage would mean that there was higher buyer liquidy and a lower percentage means that there is likely not enough supply to fulfil the demand.

Purchase rate

The purchase rate is the percentage of unique marketplace visits that leads to a sale. For example, let’s suppose we have:

- Number of unique site visits: 100 people visiting our marketplace in a month. You can track this using tools like Google Analytics.

- Number of people who transact: Only 5 of those people purchase or rent one of our listings.

Purchase rate = (Number of people who transact / Number of unique site visits) * 100

Or

Purchase rate = (5 / 100) * 100 = 5%

Although there is no hard and fast metric to determine what is a “good” purchase rate. Simon Rothman, a marketplace investor at Greylock Partners says that you should target between 30% – 60% purchase rate.

Percentage of repeat buyers

The percentage of repeat buyers is the percentage of buyers who make repeat purchases over a particular period. A high percentage of repeat buyers is a good indicator that your buyers find it easy to purchase what they need, indicating good marketplace liquidity.

To calculate the percentage of repeat buyers, you should take the total number of repeat buyers and divide this by the total number of paying customers.

Percentage of repeat buyers = (Total repeat customers / total paying customers) * 100

For example, let’s say we have a service marketplace like Upwork with the following:

- Total Paying Customers: During a 12 month period, 10,000 clients hire freelancer service providers.

- Total Repeat Customers: Within the same 12 month period, 4,000 clients initiate more than one freelancer contract.

Percentage of repeat buyers = (4,000 / 10,000) * 100 = 40%

This high percentage suggests strong marketplace liquidity, as a significant proportion of clients are finding the platform effective for finding and matching with freelancers.

Seller marketplace liquidity metrics

Seller liquidity metrics include:

Utilization rate

We’ve already seen how that measuring the utilization rate is marketplace specific. Let’s see an example calculation of the utilization rate for an on-demand marketplace like Uber.

Step 1. Define the utlization rate in context.

The utilization rate is defined as the percentage of time our service providers (drivers) are actively engaged in providing rides (i.e., picking up and dropping off passengers) versus the total time they are logged into our car rides marketplace, including the waiting time between rides.

Step 2. Collect up the required data.

Let’s say that we have the following data:

- Total Time Logged In: Suppose that the average time a driver is logged into the marketplace is 10 hours in a day.

- Time Spent on Trips: Out of these 10 hours, drivers spend an average of 7 hours actively driving passengers.

Step 3. Do the calculation.

Utilization rate = (7 hours / 10 hours) * 100 = 70%.

In our example, the utilization rate is 70%. This could be considered a moderate utilization rate and indicative of good marketplace liquidity. This means that drivers will not get tired waiting for work and they’re more likely to keep using the app.

By contrast let’s say that the utilization rate was 30%. This would represent low marketplace liquidity and you would need to find more passengers for your drivers otherwise you risk losing your supply of drivers to a competitor.

Sell through rate

The sell-through rate is the percentage of listings that result in a sale within a certain time frame. The higher the rate, the higher the marketplace liquidity.

To calculate the sell-through rate, you need to first count up all the inventory on your marketplace. You then divide the amount sold by the total number of units.

Sell-through rate = Total number of units sold / Total number of units.

For example, let’s say you have a product marketplace. If there are 10 listings and 100 units of each listing, you will have a total inventory of 1000 units on your marketplace. Let’s say you sell 100 of these units in a 1 month time window. This will give you a sell-through rate of:

Sell-through rate = 100 / 1000 = 10%.

This means that 10% of the total products listed on your marketplace will sell within 1 month of being listed. Normally the sell-through rate is broken down by the listing category, marketing channel or location.

The sell-through rate gives a good indication of your marketplace liquidity. If it is low, this might be a good indication that your product or service listings are not quite resonating with your target audience or that you need to adjust your pricing e.g. by lowering your marketplace take rate.

Marketplace insider tip

There are other ways of calculating the sell-through rate. For example, if you’re building a rental marketplace like Airbnb, you may calculate the sell-through rate as how much usage the rental property is getting vs how many properties are listed on the site.

Alternatively, if you’re building an on-demand service marketplace like Upwork, you might look at hourly availability vs the total number of service hours on offer.

Percentage of repeat sellers

The repeat seller rate is the percentage of marketplace sellers who make at least two sales within a given period of time. A high percentage of repeat sellers is a good indicator of high marketplace liquidity. This is because it indicates that sellers are finding your marketplace valuable to connect with buyers.

The percentage of repeat sellers can be calculated as:

Percentage of repeat sellers = (Total repeat sellers / total paying sellers) * 100

For example, let’s say we have a service marketplace like Upwork with the following:

- Total Repeat Sellers: During a 12 month period, 10,000 freelancer service providers are hired through the marketplace.

- Total Repeat Sellers: Within the same 12 month period, 4,000 freelancers are engage in more than one transaction.

Percentage of repeat sellers = (4,000 / 10,000) * 100 = 40%

This high percentage suggests strong marketplace liquidity, as a significant proportion of sellers are finding the platform effective for matching with hiring managers.

Buyer to supplier ratio

As we know by this point, maintaining marketplace liquidity requires you to strike a careful balance between buyers and sellers on your marketplace.

Too many buyers relative to sellers mean long wait times, limited options, buyer frustration and low user retention. Conversely, too many sellers means that sellers will struggle to find buyers for their products or services.

The question that we still need to answer is, what is the ratio of buyers to sellers that you need in order to maintain strong marketplace liquidity metrics. For example, in some cases, your seller to buyer ratio may be as low as 1:1. This is the case for residential real estate marketplaces where one seller typically only has one asset to sell.

For other marketplaces, the ratio could be 1:1000, where one seller can service 1000 buyers. This might be the case on product marketplaces that sell digital products such as stock videos or photos. In this case, one creator can list their digital assets and sell them over and over again.

Finding your optimal buyer to supplier ratio will enable you to know which side of your marketplace you need to focus on in terms of customer acquisition. Therefore, whilst the buyer to supplier ratio is not a marketplace liquidity measure. Knowing what your optimal buyer supplier ratio is, will help you to improve your marketplace liquidity.

How to improve marketplace liquidity

There are several things that you can do to improve marketplace liquidity.

Generally speaking, the easiest way to improve marketplace liquidity is to have a well thought out strategy for growing your user base. This should be developed by estimating key metrics, such as the required buyer to seller ratio.

For example, if you’re building a marketplace for travellers to book tours, you should know how many tour guides you need in order to satisfy your demand. This will allow you to strategize around how many buyers and sellers you actually need. You should then work closely with your users to ensure that you’re building a ongoing value for your users.

The key to building strong marketplace liquidity as quickly as possible is to constrain your marketplace focus to a subset of product or service categories and regions.

In the rest of this section we look at some practical ways that you can improve marketplace liquidity.

Focus on solving one problem well

The key to building marketplace liquidity fast is to focus on solving one problem well for a niche target audience. When we reviewed how to build marketplaces like Airbnb, Amazon, Turo, Uber and so on, we saw the founders of these marketplaces always focused on a small niche target audience to start with.

At Dittofi, we often see marketplace founders who are obsessed with increasing their Gross Merchandise Volume (GMV). To do this, they will quickly add categories or regions to their marketplace. This leads to a mile wide, inch deep approach to marketplace development and ultimately prolongs the time to getting to marketplace liquidity.

Remember: the first marketplace to reach liquidity first, wins. So stay laser focused on making one customer type happy first before going wide with your product.

Take an iterative approach to marketplace development

Building a valuable product is absolutely critical to improving marketplace liquidity.

The fastest way to build something that your customers value is to take a lean approach to development. This means that you should launch your marketplace early and often. The best way to do this is to use a marketplace technology with a no-code interface. These solutions allow you to build and launch fast, iterate quickly and get to product-market fit faster.

Always be thinking about supply and demand

When building a marketplace, you need someone on your team who is always thinking about supply and demand. This person should be thinking about your user acquisition channels, strategies to find new supply and demand, how to develop evergreen marketing campaigns and when is the best time to increase focus on one side of the marketplace or the other.

Invest in your sellers

In the early stages, you want your sellers to have success with your product. To do this you will need to show them how to promote and optimize their listings.

There are many examples of marketplaces such as Etsy who provide extensive handbooks and guidance to sellers on how to optimize their listing descriptions, market their offerings and offer customers a great experience.

Airbnb’s co-founder, Brian Chesky, famously went one step further. He actually visited the owners of the rental properties and helped them photograph their apartments. This allowed Airbnb not only to create a set of valuable listings, but also interact directly with their sellers and find out what challenges they had with finding renters on their marketplace.

Optimize your transaction flow

A smooth marketplace transaction flow helps increase marketplace liquidity.

Marketplace investor Josh Breinlinger classified marketplaces into three main groups based on subtle differences in their transaction flow. Josh called these:

- Double-commit marketplaces e.g. Care.com, Upwork, Thumbtack.

- Buyer-pick marketplaces e.g. Airbnb, Turo, Vrbo.

- Marketplace-picks marketplaces e.g. Uber, Lyft

Double-commit marketplaces require both the buyer and the seller to commit to a transaction. For example, on the freelancer marketplace Upwork the hiring manager must choose to work with a freelancer and the freelancer must accept to work with the hiring manager.

Buyer-pick marketplaces require the seller to list their product or services and enter in their availability. After this, it is then down to the buyer to commit to the transaction. For example on Airbnb, buyers browse lists of available properties to book.

Marketplace-picks marketplace are those where the buyer will pick a service and then buyers will automatically be matched with service providers. For example, on Uber, riders will be matched with a list of available drivers near their location.

Double-commit marketplaces tend to have the lowest liquidity out of the three. This is because substantial time is spent from both sides searching, reviewing profiles, communicating with each other and so on. With these marketplace, the focus should be on optimizing the search to fill rate.

In contrast, buyer-pick marketplaces have substantially less friction because buyers can book or purchase a listing without needing to interact with the supply side. This is the primary reason why Airbnb switched to this model with their instant booking option.

Although buyer-pick markets have less friction in their transaction flow, they generally do not work well for marketplaces with low utilization rates. For example if the seller’s products or services are utilized less than 5% of the time, they will likely not be very responsive on the marketplace and fail to keep their schedules up to date. Therefore it is very important for buyer-picks marketplaces to keep an eye on utilization rates.

Lastly, marketplace-picks marketplaces have the lowest form of friction. These therefore have the potential to be the fastest growing and most liquid of the three types of marketplace. That being said, marketplaces that adopt this model will need to pay careful attention to their supply and demand metrics.

Build a superior user experience

To build a marketplace that goes viral, you need to create a total mind blowing experience that your users will tell other people about.

To do this, Airbnb co-founder Brian Chesky does exercises with his team where they start by defining what a 1 star user experience looks like and extrapolate this to a 5 star user experience and then, an 11 star user experience.

In his interview with Reid Hofman, Brian exaplains:

“So a 1-, 2- or 3- star experience is you get to your Airbnb, and no one’s there. You knock on the door. They don’t open. That’s a 1-star. Maybe it’s a 3-star if you have to wait twenty minutes. If they never show up, and you never get your money back, that’s a 1-star experience. You’re never going to use it again.”

“So a 5-start experience is: You knock on the door, they open the door and let you in. Great. That’s not a big deal. You’re not going to tell your friend about it. You might say, ‘I used Airbnb. It worked’.

So we thought, What would a 6-star experience be? You knock on the door, the host opens. ‘Welcome to my house’. On the table would be a welcome gift. It would be a bottle of wine, maybe some candy. You’d open the fridge. There’s water. You go to the bathroom, there’s toiletries. The whole thing is great. You’d say, ‘Wow, I love this more than a hotel. I’m definitely going to use Airbnb again.”

“What’s a 7-star experience?”… and so on, all the way up to an 11-star experience. Brian explains that somewhere between a 7-star and 11-star you will find a sweet spot. His recommendations are therefore to “design the extreme and then come backward”.

Conclusion: Always be thinking about marketplace liquidity

At the start of this article we wrote that “liquidity is the lifeblood of a marketplace”. Since the marketplace’s purpose is to match buyers and sellers, it’s fair to go one step further and say that liquidity is the marketplace, since without liquidity you have nothing.

At Dittofi we help new and existing marketplace operators use technology to track key marketplace metrics. This includes using our hybrid no-code builder to develop custom built data analytics dashboards that you can use to track key marketplace metrics. Using our visual development studio, these can be developed 10 times faster than traditional code.

We also have a comprehensive suite of marketplace templates that include all of the foundational features that you need to build and launch a marketplace. Each template is built on a modern, high performance tech stack which you can access and own through our hybrid no-code studio. Lastly, all of the code for our marketplace templates can be rapidly customized using Dittofi’s visual development studio.

Using Dittofi, you’re therefore able to build an entirely custom two sided marketplace, build custom tools to track marketplace liquidity and (in fact) build any bit of custom software 10x faster and without coding.

If you would like any help looking further into marketplace development or how to setup a marketplace monitoring dashboard, schedule a call with one of our marketplace specialists and they’ll be able to direct you. Alternatively, sign up to Dittofi for a 14 day free trial and check out some of our template marketplace solutions.

And… in case we don’t hear from you, happy marketplace building!

Become a Marketplace Insider

Join our inner circle for exclusive insights, coveted trade secrets, and unparalleled strategies – your journey to marketplace dominance begins here.