The world of online tours and experiences is huge.

The market is split into two segments: foreign tours, taken by travellers and the local tours market. Of this, foreign tours account for $320 billion of the total market and local tours account for $1.4 trillion.

Whilst the main players in this market are Viator (owned by TripAdvisor) and Expedia Local Tours, there are many alternatives to these travel giants. Each Viator competitor differentiates itself with unique tours, target audience and their client acquisition strategies.

In this article, we look at the top Online Travel Agency (OTA) competitors to Viator.

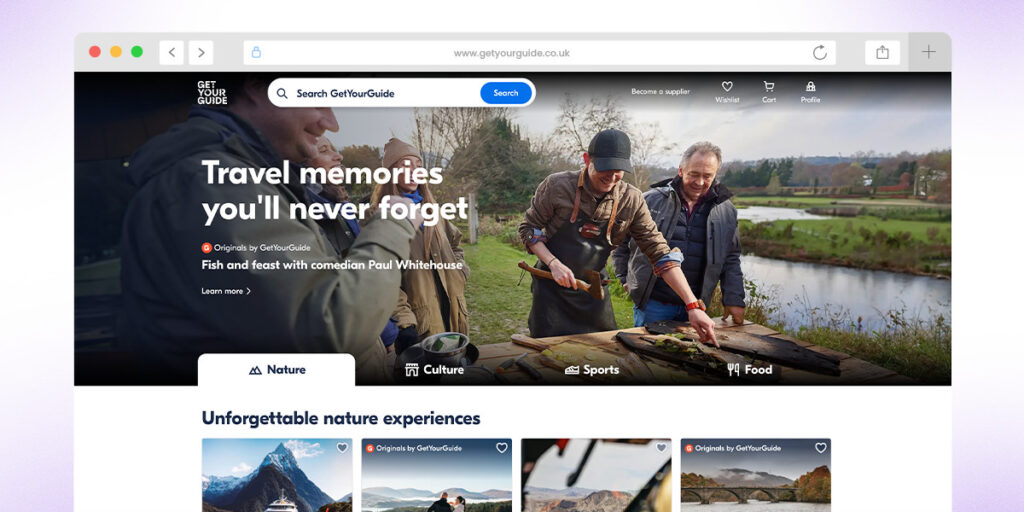

1. GetYourGuide taps into AI

The first Viator competitor we investigate is GetYourGuide.

GetYourGuide is a business-to-consumer (B2C) travel marketplace for unique and rare experiences. The idea is that local tour operators and guides are able to create unique tours and then use GetYourGuide to display these experience to travellers who want to book tours.

Unlike Viator who take a business-to-business (B2B) approach to customer acquisition, GetYourGuide is building a B2C online marketplace. In this model, the company targets small local tour guide businesses of 1 – 10 people. The platform then markets these tours to individual consumers. GetYourGuide then takes a commission on each transaction.

There are several challenges to GetYourGuide approach. For example, many tour operators still work off pen and paper. This means that they are not yet ready for a more technology intensive model. Meanwhile on the consumer side, less than 13% of individuals purchase trips ahead of their travel, preferring instead to buy them offline when arriving at their destination.

GetYourGuide aims to address these challenges with the use of AI.

GetYourGuide's AI plans

GetYourGuide aims to use AI to solve challenges faced by tour guides lacking in technical expertise. Specifically, the company aims to use AI to improve the operations of tour guides, give insights into what tours they should create and to help the small tour operators build and distribute content.

Meanwhile on the consumer side, GetYourGuide aims to use AI to improve how consumers to book their tours before travelling to their destination. The thinking behind this is that the current methods used by consumers to search for tours are very mechanical and time intensive. GetYourGuide predicts that this causes travel planning fatigue which leads to the majority of consumers preferring to book offline at their destination.

Therefore, GetYourGuide focus is on developing an AI driven search that will learn from consumers so that it can suggest trips that the consumer wants, before they know that they want it. The goal of this is to get travellers booking their tour itinerary before going on holiday. So far GetYourGuide has not been able to achieve this although, as we shall see they are not alone in their predictions about the travel market.

CEO of GetYourGuide Johannes Reck explains these ideas at the Skiff Global Forum (shown below).

To learn more about GetYourGuide, read how to build a website like GetYourGuide.

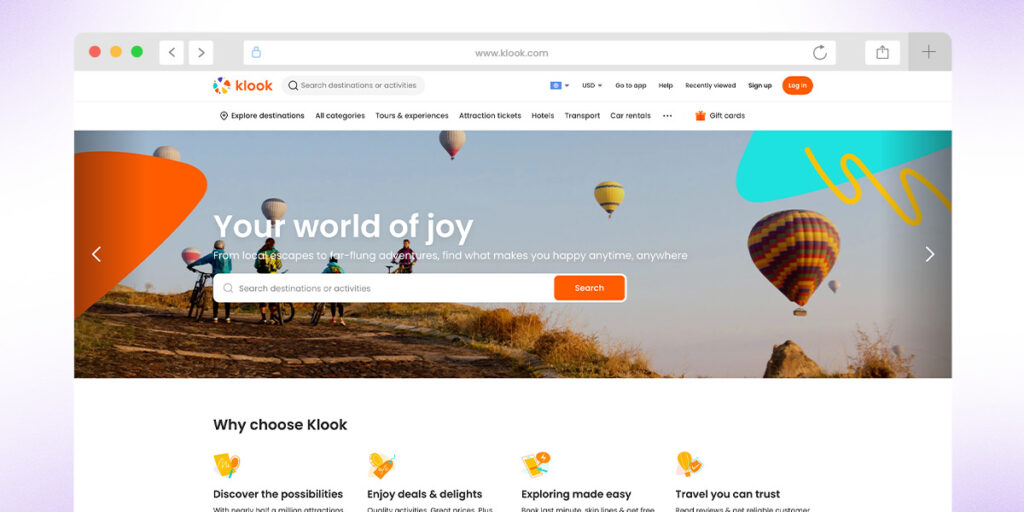

2. Klook looks to Gen-Z

A second Viator competitor is Klook.

Klook is a B2C travel marketplace that focuses on the Asia Pacific region. Specifically, Klook competes most heavily with Viator in Taiwan, Hong Kong and Singapore, where they are the dominant travel marketplace.

In addition to the regional focus, Klook has carved out a marketplace niche by targeting a young, more tech-savvy demographic than Viator. Klook does this a number of ways, including through their marketing channels and the products offered on their marketplace.

In the case of their marketing channels, Klook uses the Klook Kreator program where influencers are used to showcase their unique travel experience on social media platforms like Instagram and TikTok.

Meanwhile the products offered by Klook promote the use of city passes. These passes are designed for travellers to see as many places in a single day as possible. This allows the younger Gen-Z crowd to maximize their photo-taking opportunities to share with their friends.

Klook also has a broader array of inventory that includes food-themed walking tours, theme parks, experiences linked to entertainment, festivals and mega events. For instance, Klook was the preferred partner for the Taylor Swift concert in Singapore and the OTA has recently secured launch partnerships for Disney’s Hong-Kong’s frozen theme park and the Warner Brother Studios in Japan.

Lastly, the online agency has built up an online inventory in outdoor activities and adventure tourism through PADI diving and certification partnerships that further attract a younger, sportier set of travellers compared to Viator.

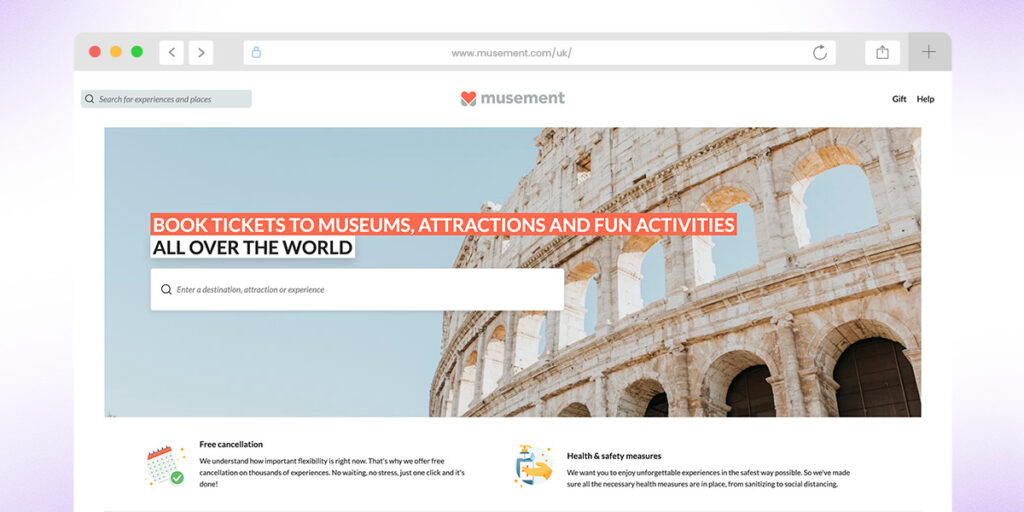

3. TUI Musement B2B focus

Musement is a newer Viator competitor than GetYourGuide or Klook.

Musement was founded in 2013 as an Italian based travel marketplace. The platform was acquired by the German based TUI Group in September 2018 when it rebranded to TUI Musement.

The CEO of TUI Musement is David Shelp who explains that Musement is much more like Viator and Expedia than GetYourGuide and Klook. This is because TUI Musement focuses much more heavily on distributing its tours through B2B partnerships compared to GetYouGuide and Klook’s B2C model.

The B2B approach is most clearly evident in the way TUI Musement markets its tours to TUI’s 21 million annual users. Most of these annual users buy holiday packages, with a total of 10 million tours and customer activities purchased in 2019. Out of the 10 million tours and activities sold, 3 million of these were related to cruise line shore excursions offered by companies such as Carnival and Royal Caribbean under their own brands.

On the B2B side, TUI Musement continues to double down and now powers Booking.com’s attractions lab which allows Booking.com users to purchase TUI Musement tours directly through Booking.com.

Although TUI Musement focus is primarily on B2B sales, the company also sold more than 1.2 million customers directly through TUI Collection which is a product that has some parallels with GetYourGuide’s Originals. This is not the travel marketplace’s core focus however and Schlep has openly stated that TUI Collections opening TUI Musement marketplace to smaller suppliers that are targeted by Klook and GetYourGuide would be a risk to their brand.

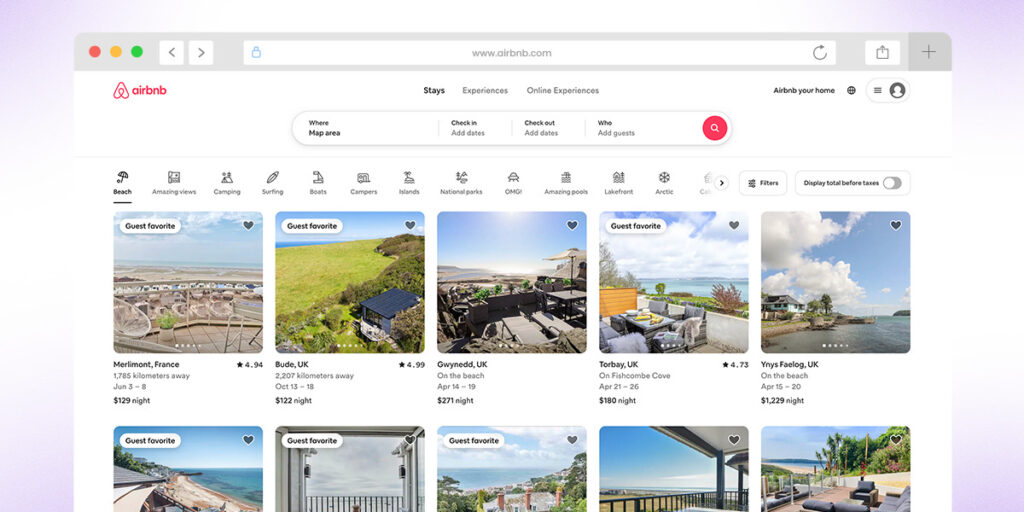

4. Airbnb Experience, live like a local

It’s no surprise that Airbnb is on our list of Viator competitors.

It was always the case that the home sharing giant would need to become a more conventional travel seller. There is a precedent here, for example Booking.com which began with a focus on hotels has since expanded into alternative accommodation, car rentals, tours, activities and flights.

Airbnb’s tours market is very niche. With their slogan, “live like a local”, the platform is clearly targeting people who don’t want to be seen as tourists. Group sizes are limited to a maximum of 10 people and Airbnb Experiences are marketed towards people who are already staying in a location. This final point is particularly interesting. Right now only 4% of the revenue for online tours is captured ahead of a trip. because it runs counter to the belief that GetMyGuide has, which is that (in the future) consumers will start to book their tours ahead of their trips.

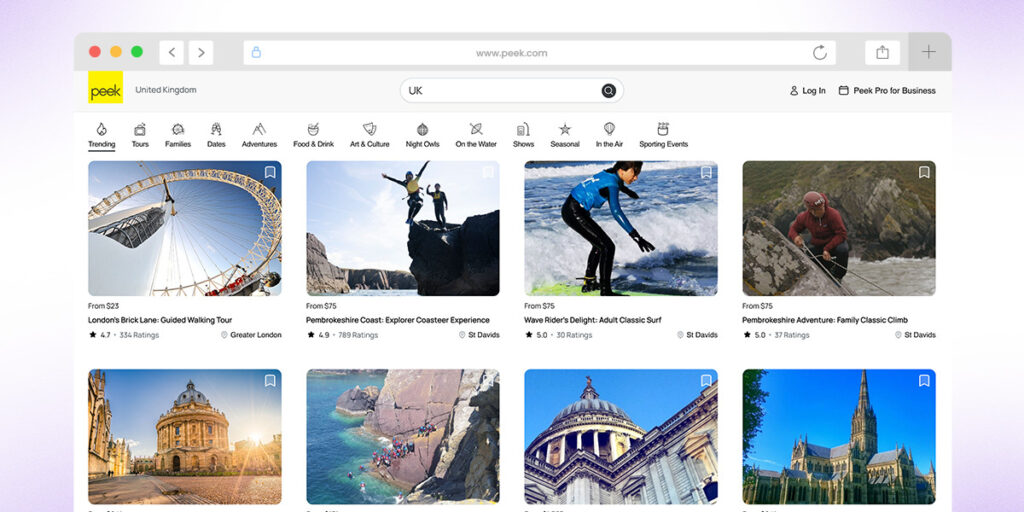

5. Peek “shopify for experiences”

The strongest competitor to Viator in the US is Peek. It is a platform company with a marketplace add-on. Let’s dive into exactly what this means.

On the consumer side, Peek is a regular OTA. The company offers personalized and curated destination activities and experiences through their travel marketplace. As with the other Viator competitors, these experiences are offered via a website or iOS app. Peek’s activities run the gamut of adventure sports to fine dining.

For consumers, Peek differentiates itself by making sure that the tours offered are precisely chosen according to the traveller. The idea is to keep the options manageable and not to overwhelm users with a vast collection of similar items. When consumers first open up the app, they swipe through a selection of images to give users a sense of what they’re interested in. From their the platform will immediately start making recommendations of what tours are best for them. Do you see the similarities with GetYourGuide’s AI approach?

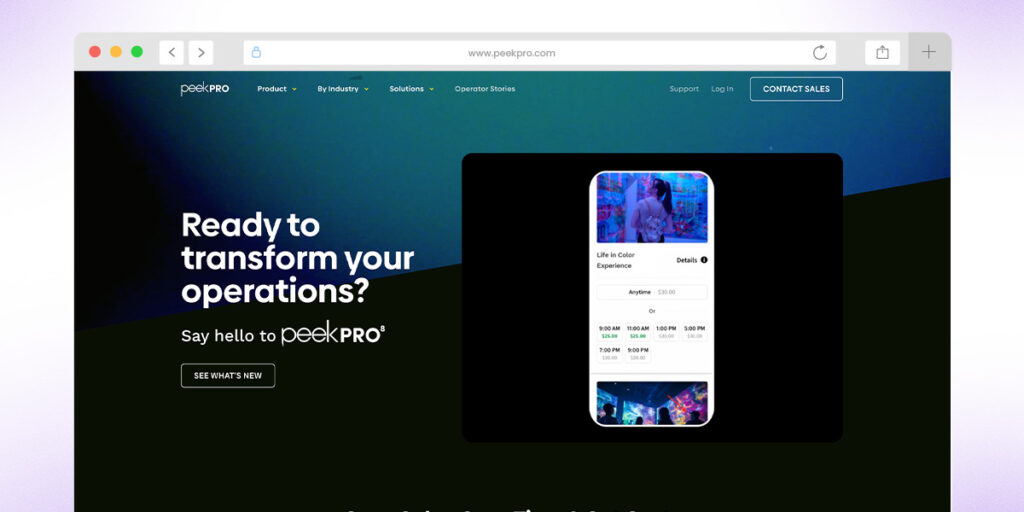

On the tour operator side, Peek offers a Shopify-like experience through their product PeekPro. This product is designed specifically for tour and activity operators to manage their businesses more efficiently.

Essentially Peek’s strategy to solve the marketplace chicken and egg problem, and maintain a balanced supply and demand, is to onboard tour operators to PeekPro. The idea is that this platform provides inherent value for tour operators to manage logistics and automating upsell opportunities. This can increase both revenue and profitability for tour operators. Once operators adopt PeekPro, it’s easy for Peek to list their chosen tours directly on Peek’s travel marketplace.

Peek’s approach is similar to OpenTable’s strategy in the restaurant space which positions Peek as the only OTA on our list to potentially benefit from both a platform network effect and a two-sided network effect. Platform network effects add an extra layer of defensibility to their business model.

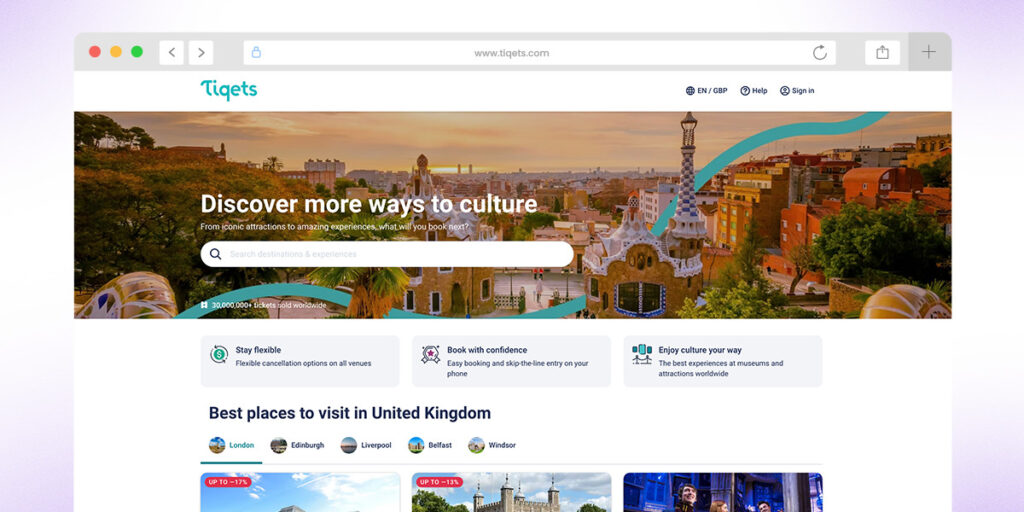

6. Tiqets making culture more accessible

Next on our list of Viator competitors is Amsterdam based marketplace Tiqets.

Tiqets has managed to carve out a niche for itself in the crowded OTA marketplace vertical by specializing in the cultural and experimental segment. Consumers are able to visit Tiqets for instant booking of museums and other mainstream attractions. This includes cultural experiences through to iconic destinations such as the Statue of Liberty and London Eye.

In 2023, Airbnb became a minority shareholder in Tiqets, indicating that Airbnb realizes that the Airbnb experience marketplace only caters to a limited segment of travellers.

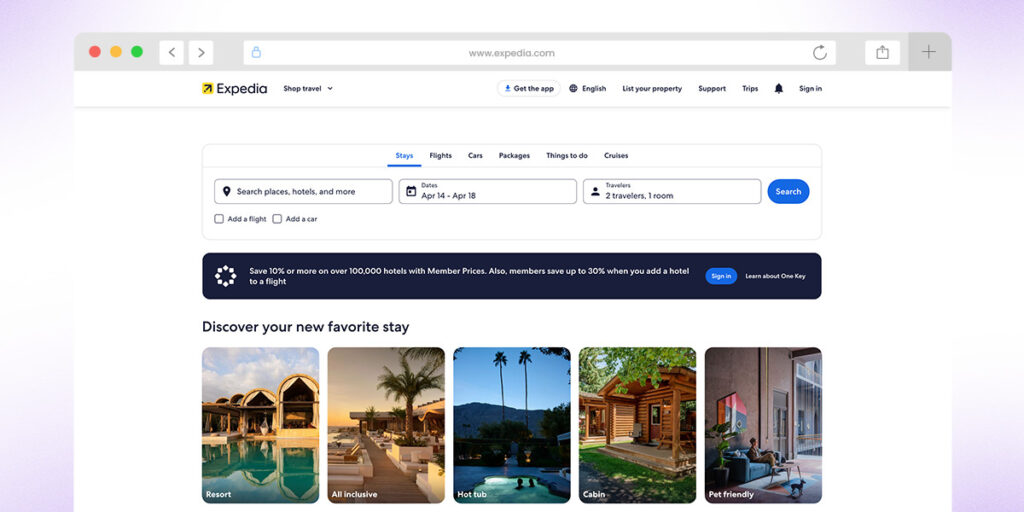

7. Expedia Local Expert

No list of Viator competitors would be complete without looking at the giant tours marketplace space, Expedia Local Expert.

Expedia Local Expert was launched back in 2014 and is part of the Expedia Group that operates the well-known Expedia travel booking platform that offers hotels, cruises, flights and no, “Things to do”.

According to their site, Expedia Local Expert is a one-stop resource for local activities, tours and transportation in more than 750 different vacation destinations. For sellers on Expedia Local Expert, their products are distributed in 17 different language sites, across 57 different websites including Orbiz, AirAsiaGo, Hotels.com and Ebookers.

Again, similar to Viator and TUI Musement, the strategy to drive traffic is by building B2B partnerships that enable Expedia to expand their reach, sharing customer bases and uncovering cross-selling opportunities.

Conclusion: Room for more Viator competitors

Whilst the travel industry is dominated by a few large OTAs such as Expedia and Viator, there is always room for new entrants into the space.

Viator competitors can come from various different channels such as building an OTA for a specialized niche such as remote destinations or by focusing on an emerging trend in travel.

Each new Viator competitor must carefully consider their target market, find tours that speak directly to that target market and then find ways to get into the consumers line of search when they’re planning or when they’ve arrived at their destination. This can be with the use of paid ads, B2B channel partners as in the case with TUI Musement and Tiqet. and so on.

New entrants should also consider how to create packages that speak directly to target audiences as demonstrated by Klook’s approach to Gen-Z.

If you’re thinking about building a business in the travel industry, check out some more examples of how to build a travel marketplace’s using Dittofi’s hybrid no-code marketplace solution.

Using Dittofi, you are able to build a travel marketplace like Viator in days rather than months, allowing you to enter this fast growing market with your own unique brand.

Become a Marketplace Insider

Join our inner circle for exclusive insights, coveted trade secrets, and unparalleled strategies – your journey to marketplace dominance begins here.