Subscription-based marketplaces are everywhere. Whether it’s SaaS platforms, membership-driven content hubs like Patreon, or digital storefronts like Etsy, these platforms have transformed the way people buy and sell goods and services online. But there’s something many people don’t realize — unlike traditional e-commerce platforms, these marketplaces often don’t carry insurance for transactions happening on them.

That might sound surprising. After all, when you shop on Amazon, book a ride with Uber, or reserve a stay on Airbnb, these companies offer various forms of insurance coverage or buyer protection. But subscription marketplaces operate under a completely different business model. Instead of directly selling goods or services, they simply provide access to a platform — and this subtle difference allows them to avoid legal and financial responsibilities that would normally require them to carry insurance.

But how exactly do they do it? Is this just a clever loophole, or is it a well-established legal strategy? And what happens when things go wrong? Let’s take a closer look at how subscription-based marketplaces shift liability away from themselves — and whether they’re truly free from risk.

Why Subscription Marketplaces Operate Differently

To understand why subscription-based marketplaces don’t need traditional insurance, it’s helpful to compare them to traditional transaction-based platforms — the ones we’re all familiar with, like Amazon, Uber, and Airbnb. These companies may act as intermediaries, but they still take on some level of responsibility for the transactions happening within their ecosystem.

For example, Amazon isn’t just a place where sellers list their products—it’s an active participant in the process. Amazon manages order fulfillment, handles customer complaints, and enforces strict rules on product quality, shipping times, and refunds. If something goes wrong, Amazon steps in, offering buyer protections and warranties, which inevitably exposes it to legal and financial risks. Because of this, Amazon carries various forms of insurance, including product liability coverage.

Similarly, Uber, though technically a platform connecting drivers with riders, still assumes some responsibility for safety and service quality. To protect itself and its users, Uber provides insurance for drivers and passengers, ensuring coverage in the case of accidents.

Airbnb, another major platform-based business, initially positioned itself as simply a listing service where homeowners and travelers could connect. However, after facing legal pressure and high-profile lawsuits over unsafe rental properties, Airbnb was forced to implement host protection insurance, which covers damages caused by guests. This marked a significant shift in how much liability the company was willing (or forced) to accept.

The Business Model That Reduces Liability

Rather than charging per-transaction fees (like Amazon or Uber), subscription-based platforms make money through:

- Monthly or yearly subscription fees (e.g., SaaS marketplaces, membership-based content platforms)

- Listing fees or premium placement fees (e.g., Etsy’s Pattern tool, Patreon’s membership tiers)

- Revenue-sharing models, where a percentage of sales goes to the platform, but the seller remains the vendor of record (e.g., Shopify’s App Store)

Because these platforms aren’t facilitating individual transactions in the traditional sense, they avoid being classified as retailers, service providers, or employers. This exempts them from many of the legal responsibilities that would typically require insurance coverage.

Etsy’s Pattern Tool: A Case Study in Liability Avoidance

A great example of this strategy in action is Etsy’s Pattern tool. Etsy is well known as an online marketplace where independent artisans sell their products, but what’s often overlooked is how Etsy cleverly distances itself from legal responsibility.

With Pattern by Etsy, sellers can create their own branded store, using Etsy’s software and infrastructure. However, Etsy itself is not the retailer—it merely provides the tools for the seller to operate their business. If a customer buys something through a seller’s Pattern store and there’s a problem (like a defective product or a fraudulent listing), the legal responsibility falls entirely on the seller — not Etsy.

This distinction is not accidental; it’s a deliberate business strategy that allows Etsy to benefit from seller activity without exposing itself to lawsuits, consumer protection claims, or product liability cases.

The Vendor of Record Loophole: How Marketplaces Avoid Liability

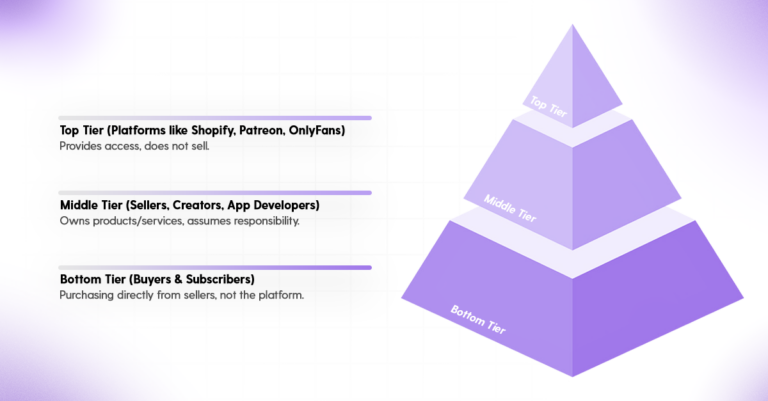

At the core of this strategy is something called the Vendor of Record (VoR). This is the legal entity responsible for the product or service being sold. In traditional e-commerce, the platform itself often takes on this role. But subscription marketplaces are careful to shift this responsibility onto their sellers or service providers.

When you buy an app from the Apple App Store or the Shopify App Marketplace, for instance, Apple and Shopify aren’t the ones legally responsible for the product — you’re actually entering into a transaction with the app developer, who is the Vendor of Record. If there’s a problem, it’s up to the developer to handle refunds, disputes, or legal issues, not Apple or Shopify.

The same goes for Patreon and OnlyFans. These platforms allow content creators to sell subscriptions, but they make it very clear that creators are independent businesses responsible for their own content and interactions with subscribers. Patreon and OnlyFans only provide the platform, and their Terms of Service make it explicit that they are not liable for what happens between creators and their fans.

This legal strategy is further reinforced by terms and disclaimers that protect the platform. If you look at the fine print in most subscription-based marketplace agreements, you’ll often find clauses stating that the platform is merely a facilitator and that sellers or service providers assume full responsibility for their transactions.

How Subscription Marketplaces Manage Risk Without Insurance

Even though subscription marketplaces avoid traditional insurance needs, they aren’t completely hands-off when it comes to risk management. Instead, they use a mix of legal agreements, third-party services, and platform policies to protect themselves.

One of the biggest ways they reduce liability is through strict seller agreements. Before someone can list a product, service, or membership on a subscription marketplace, they usually have to agree to terms that explicitly state that the platform itself is not responsible for any issues that arise. This way, if a dispute happens, the marketplace can point to these agreements and say, “We’re just the middleman.”

Another common strategy is outsourcing payment processing. Many of these platforms don’t handle payments directly — instead, they use third-party providers like Stripe, PayPal, or Square to process transactions. This means that if there’s a dispute over money, the marketplace doesn’t have to deal with it — it’s the payment processor’s problem.

Some marketplaces also offer escrow services or buyer protection programs as a way to build trust without assuming full liability. For example, Etsy has a Buyer Protection Program that helps resolve disputes, but it still holds sellers accountable for fulfilling orders. Similarly, platforms like Upwork use escrow payments to ensure freelancers get paid only after work is approved, but they don’t guarantee the quality of work themselves.

To further minimize risk, many subscription-based marketplaces invest heavily in fraud prevention tools and user rating systems. By using AI to detect suspicious activity and allowing customers to leave reviews, these platforms create a self-regulating ecosystem where bad actors get filtered out. This eliminates the need for traditional insurance-backed guarantees while still maintaining trust among users.

Are Subscription Marketplaces Truly Risk-Free? The Hidden Liabilities

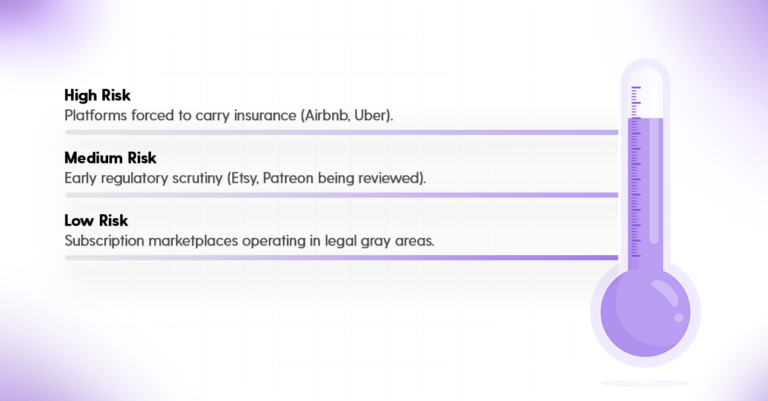

While subscription marketplaces have crafted legal and operational strategies to distance themselves from liability, that doesn’t mean they’re completely shielded from risk. The reality is that regulatory landscapes are constantly evolving, and governments, courts, and consumer advocacy groups are paying closer attention to how these platforms operate.

A prime example of this is Airbnb, which initially positioned itself as just a listing platform, claiming it had no direct responsibility for what happened inside rental properties. However, after several high-profile incidents, including guest safety concerns, property damage disputes, and even legal battles with local governments, courts ruled that Airbnb could no longer wash its hands of liability. Instead, the company was forced to introduce host liability insurance, adding significant operational costs to its business model.

This serves as a cautionary tale for all subscription-based marketplaces. Just because a platform is designed to legally shift responsibility onto sellers, service providers, or hosts doesn’t mean regulators will always agree. If a marketplace becomes large enough or influential enough, it may find itself forced into compliance with new legal requirements — whether it wants to or not.

The Growing Influence of Consumer Protection Laws

Beyond individual court cases, consumer protection laws are becoming more aggressive, particularly in regions like the European Union and California. Lawmakers are actively challenging the notion that platforms can profit from transactions while escaping accountability. Some of the biggest areas of concern include:

- Safety Regulations: Platforms that enable peer-to-peer transactions, from food delivery services to digital product marketplaces, are facing increased scrutiny over safety standards and product liability.

- Worker Classification Laws: Some platforms claim that service providers (such as freelancers or gig workers) are independent contractors, but laws like California’s AB5 are challenging that classification, forcing companies like Uber and DoorDash to rethink their legal approach.

- Anti-Fraud and Transparency Requirements: Some jurisdictions require marketplaces to take more proactive measures to prevent scams, deceptive practices, or counterfeit sales — even if they aren’t the official seller of record.

The Fine Line Between Protection and Liability

The challenge for subscription marketplaces is walking the fine line between providing a trusted, regulated environment and remaining legally insulated from liability. The more a platform intervenes in disputes, enforces rules, or offers buyer protections, the more courts may view it as an active participant in transactions, making it harder to argue that it’s simply a facilitator.

For example, if Etsy starts heavily regulating product quality or Patreon takes an active role in moderating content, they risk being seen as directly responsible for what happens on their platforms. While these policies increase trust and attract users, they can also increase legal exposure.

The key takeaway? No subscription-based marketplace is truly risk-free. Even with a well-structured legal framework, platforms must stay vigilant, continuously monitor regulatory changes, and adapt their business model and risk management strategies to ensure they don’t find themselves on the wrong side of the law.

Want to dive deeper into marketplace insurance requirements? Check out this comprehensive guide on whether marketplaces need insurance.

The Future of Subscription Marketplaces: Balancing Growth, Risk, and Regulation

Subscription-based marketplaces have revolutionized digital commerce by shifting away from traditional sales models and instead focusing on platform access. By ensuring that sellers and service providers act as the Vendor of Record, these platforms have successfully minimized their legal and financial responsibilities, avoiding the burden of costly insurance policies. This approach has allowed them to scale quickly, reduce overhead, and create thriving ecosystems where creators, merchants, and service providers can connect with customers worldwide.

However, this model isn’t without risk. As governments introduce new regulations and courts reexamine liability frameworks, the landscape for subscription marketplaces is changing. Platforms that once operated in a legal gray area may find themselves subject to new rules designed to protect consumers and ensure fair business practices. From evolving consumer protection laws in the EU to stricter gig economy regulations in California, policymakers are beginning to hold digital platforms more accountable for the transactions happening within their ecosystems.

To remain competitive and legally secure, subscription marketplaces must stay ahead of these changes. This means not only refining their terms of service and seller agreements but also implementing robust risk management policies, leveraging third-party financial services, and ensuring compliance with emerging laws. Transparency, trust, and proactive legal safeguards will become increasingly crucial as regulators scrutinize marketplace operations.

For entrepreneurs and business owners looking to build their own subscription-based marketplaces, the key takeaway is clear: your business model dictates your legal and insurance responsibilities. A well-structured platform can save you from unnecessary costs and liabilities, but only if you understand the risks and build with compliance in mind. The smartest platforms will strike a balance — leveraging their legal advantages while preparing for the inevitable shifts in global regulation.

As the subscription economy continues to grow, the platforms that embrace adaptability and responsible business practices will be the ones that thrive.

Protect Your Marketplace & Maximize Revenue!

Build a marketplace that’s profitable and legally secure. Learn how to minimize liability and avoid insurance pitfalls.