GMV Definition

GMV means Gross Merchandise Volume or Gross Merchandise Value. It refers to the total volume or value of merchandise sold on an online marketplace over a period of time. This is different from the marketplace revenue (or take rate) which is the percentage of the total volume transacted on an online marketplace.

In the world of online marketplaces, GMV is “the great equalizer”.

This is because GMV provides a standardized measure of the total value of goods or services sold across different marketplaces.

Investors use it to directly compare competing businesses, to help determine market share and growth rates. However, GMV only gives you one way of looking at a marketplace and, for this reason, it is often referred to as a vanity metric that fails to capture a complete picture of the marketplace health and sustainability.

In this article, we take a look at:

GMV meaning

GMV means the gross merchandise volume or gross merchandise value. It is calculated as the total volume or value of all products or services that are transacted on a two sided marketplace. GMV is calculated prior to the reduction of any fees or expenses.

GMV is calculated by multiplying the total number of goods or services that are sold on the marketplace by the sale prices of those goods or services:

Gross Merchandise Volume = Sales Price of Goods or Services x Number of Goods Sold.

Examples of GMV

In the first quarter of 2024 the peer to peer marketplace Amazon reported an increase of 12.2% in their GMV. In comparison, the average GMV growth rate for ecommerce marketplaces was 8% for the same period. Therefore, by a direct comparison, it appears that Amazon is performing better than other product marketplaces; however, the GMV only tells part of the story.

To see why this is the case, let’s look at two online marketplaces, Amazon and Etsy. For the sake of simplicity, let’s say that during the first quarter of the year, Amazon sells 10,000 products at a single price of $5. This creates a GMV for Amazon of 10,000 x $5 = $50,000. Meanwhile let’s say that Etsy sells 5,000 products for $6. This produces a GMV of 5,000 x $6 = $30,000.

In this example, Amazon’s GMV of $50,000 is bigger than Etsy’s GMV of $30,000. However, the GMV in isolation does not tell us the complete story. This is because both Amazon and Etsy only keep a percentage of the revenue. The rest of this goes back to their providers who use the marketplaces to sell their products.

To see a more complete picture, we therefore also need to consider each of the marketplace’s take rate (or commission). For example, let’s say that Amazon charges 2% commission for products sold on their marketplace whereas Etsy charges 20% commission. In this example (and it’s only an example), Amazon will make $50,000 * 2% = $1,000 in revenue whereas, Etsy will make $30,000 * 20% = $6,000 in revenue.

So in our example, even though Etsy’s GMV is lower than Amazon’s, Etsy actually makes more revenue because of their higher take rate.

Marketplace Insider Tip

Your marketplace take rate should make your marketplace the de facto place to transact. Charging excessively high commissions invites competition. As Amazon’s Jeff Bezos is fond of saying, “your margin is my opportunity”.

For a more detailed discussion around take rate, read What is “take rate” (or commission)?: A comprehensive guide (2024).

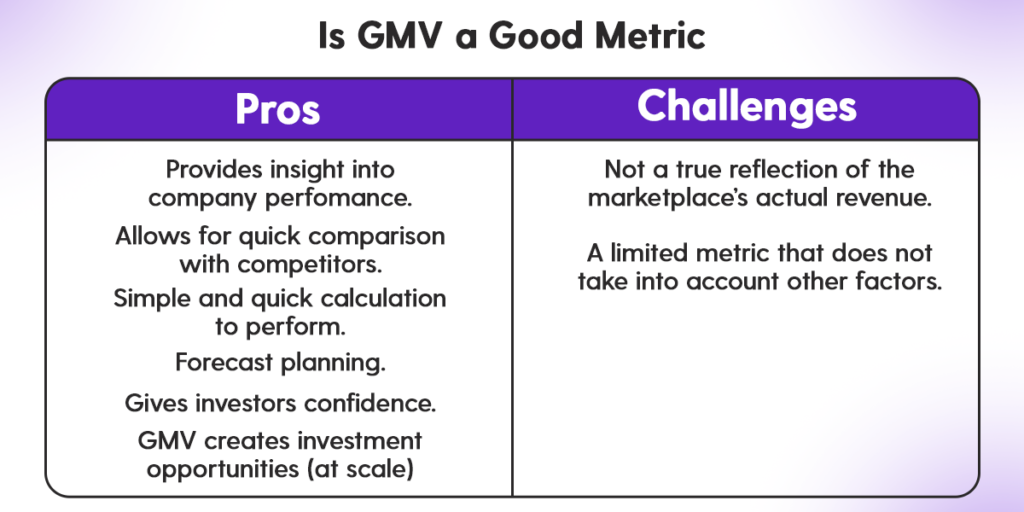

Is GMV a good metric? (Does GMV really matter)

GMV is considered a good marketplace metric however, it should not be considered in isolation. This is because, whilst GMV offers marketplaces a standardized view of performance, it does not take into account marketplace metrics that provide a fuller picture of the marketplace’s health and sustainability.

In this section, we break down how to think about GMV, so that you can know what are its pros and challenges as a marketplace metric.

GMV Pros (is GMV a good marketplace metric to track)

GMV is generally considered a good marketplace metric.

It is particularly useful for early stage marketplaces who need a simple way to monitor the growth of their marketplace. That being said, GMV has to eventually convert into marketplace revenue however, how much revenue and when GMV converts, is unique to each marketplace.

In this section we break down the pros of GMV as a marketplace metric.

GMV provides insight into company performance

Marketplaces are all about facilitating transactions. Without transactions, there is no marketplace. Since GMV measures the total number of transactions and the value of these transactions, it is a good indicator of your marketplace’s performance. A growing GMV tells you that more and more transactions are actually being done on your marketplace which means that your marketplace users are finding value in your product.

GMV allows for quick comparison with competitors

GMV can be used as a metric to gauge the scale and market share of different marketplaces in the same industry. This information can be used to help strategically position your marketplace. For example, if you see that your competitors are growing faster than you, you may decide to specialise your marketplace on a more niche vertical, adjust pricing strategies and so on.

It’s worth noting that for early stage marketplaces, getting access to competitor GMV metrics will likely not be possible. However, potential investors will use your GMV to compare your marketplace against the competition within your vertical.

Simple and quick calculation to perform

In his book “Lean Startup”, Eric Ries emphasizes the importance of using easy-to-set-up metrics in startups. He advocates for simple, actionable metrics that everyone in the organization can understand and implement quickly.

Ries highlights the value of straightforward measurement tools that facilitate rapid learning and adaptation, which are crucial for startups operating under conditions of extreme uncertainty. This approach helps startups focus on what truly matters—validated learning and iterative improvement—without getting bogged down by overly complex data analysis.

For marketplaces just starting out, GMV is the easiest and simplest metric to understand and track. This is one of the major advantages of using GMV for small businesses. A growing GMV can give investors confidence to invest however, as we shall see, it’s important not to optimize your marketplace for investor metrics.

GMV creates investment opportunities

When marketplaces connect buyers and sellers, they often hold onto buyers money for a period of time before paying it out to sellers. This is to ensure that the transaction goes ahead smoothly. The rental marketplace Airbnb, for example, can hold onto renters income for sometimes months at a time before paying it out to property managers.

During this time, Airbnb invests this money for profits before disbursing them. For example, in January 2023, the Wall Street Journal published a report in which they detailed how the travel marketplace Airbnb made more than $58 million in interest income from its own cash, as well as from customer’s advanced bookings.

Therefore, although Airbnb only takes a percentage of the booking value as revenue, the company’s massive GMV means that it has a lot of short term cash sitting on its books. By investing this cash into the money markets, Airbnb has been able to transform their high GMV into more revenue. This is a common strategy used by marketplaces.

GMV helps forecast demand and supply

By analyzing GMV over time, marketplaces can identify trends in consumer behaviour such as seasonale fluctuations. This data can be used to help predict future demand which in turn enables better management of supply. For example, if you know that your marketplace will be inundated with orders during summer holidays, you can focus on getting supply on your marketplace. This allows the marketplace to prepare to meet the rising demand as summer approaches.

Additionally, GMV allows the marketplace to track the effectiveness of marketing campaigns. For instance, if you increase your marketplace blog content by 10 new articles per month and this attracts approximately 10% – 20% increase in organic traffic on the demand side, which translates to 20 – 40 new transactions per month, then you know that you have to keep increasing supply in lock-step with demand.

Challenges: Is GMV a vanity metric?

Many people say that GMV is a vanity metric.

A vanity metric is one that makes a marketplace look impressive due to high transaction volumes, but it does not necessarily indicate the true health or profitability of the business. For instance, you may be able to boost your GMV simply by adding more product or service categories, or launching your marketplace in new cities.

While these GMV growth strategies can temporarily boost your marketplace’s GMV, long-term growth is unsustainable if the platform suffers from poor customer retention, low net promoter scores, and high customer acquisition costs.

In this section, we take a look at what are some of the challenges with GMV and how GMV can become a vanity metric.

Not a true reflection of the marketplace’s actual revenue

GMV is a great metric for early stage marketplaces to track. However, as marketplaces get more mature it becomes less important. This is because GMV in isolation cannot tell us about the health of the marketplace.

Marketplace founder and investor Benjamin Narasin, says of GMV that “the critical question is whether GMV can ever convert into something of value”. For instance, an early stage marketplace may prioritize driving transactions and as such opt for a low or even no take rate. However, if, as the marketplace expands, there is never any opportunity for the marketplace to monetize the large number of transactions taking place on their platform, then this will eventually cause the marketplace to fail.

Benjamin Narasin points towards his experience founding and investing in marketplaces and explains that, at an early stage, marketplaces can raise capital based purely on GMV however, as they go through successive funding rounds, it becomes increasingly important for the marketplaces to find ways to monetize their GMV whether that be through commissions, listing fees, lead fees or other marketplace business models.

A limited metric that does not take into account other factors

We’ve already seen that the GMV is just one metric and that it doesn’t give a complete picture of the marketplace health. However, whilst it is true that the GMV doesn’t tell you everything, it is still a very important metric. This is especially the case for early stage marketplaces who have limited resources to create a complex data analytics framework and should instead be focused on finding problem-solution and product market-fit.

Marketplace insider tip

When you’re a startup use easy-to-setup metrics which are also easy to understand.

When I was doing the pre-seed round for Dittofi, VCs often asked for complex reports about the performance of our user base. At the time, the reports we had were only very basic and didn’t include the level of detail that the VCs were asking for.

My response to the VC was that we had the level of reporting that made sense for a company of our size. I wasn’t going to start building out complex data dashboards when it was just my brother and I doing 90% of the work and we had less than 100 users. At this point we had exactly the right amount of reporting in place for a company of our size.

Gross Merchandise Value vs Gross Transaction Value

Gross Merchandise Volume or GMV means the total value of products or services sold through a marketplace.

Gross Transaction Volume or GTV means the total value of products or services sold through a marketplace plus any extra charges like shipping or service fees that also flow into the business.

To calculate GTV:

GTV = Total number of orders * (order cost + delivery fees)

GTV is important as it takes into account the complete monetary flow of sales within a business. Marketplace operators can break down the GTV into its components to better understand their business.

For example, let’s suppose you’re running a product marketplace and you include shipping rates. You may want to try out two scenarios:

Scenario 1: Offer fixed rate shipping at $5 per transaction.

Scenario 2: Offer free shipping over a particular order value, say $50, otherwise the buyer pays a $10 fixed fee.

Whilst scenario 1 may incentivize lots of frequent transactions, scenario 2 may incentivize users to transact hire value amounts. It’s only by analyzing the components of GTV and the impact on consumer buying behaviour that you can determine which scenario is better for the marketplace.

What other metrics should you consider alongside GMV

As we have already seen, although GMV offers valuable insights to your business, GMV does not provide a complete financial overview of your marketplace. Some of the obvious drawbacks of looking only at GMV include:

- Excludes actual revenue: GMV does not include how much actual revenue the marketplace makes. This means it can only be used to demonstrate revenue potential and nothing more.

- Lack of profit information: GMV does not allow you to see actual profit figures. This means that using GMV alone, you cannot gauge the actual financial health of your marketplace accurately.

- Excludes expenses: GMV does not account for any accrued and fees associated with sales such as shipping costs, marketing, sales or platform fees.

- Inconsistent growth: When marketplaces prioritize GMV growth, this does not necessarily translate into revenue growth.

- Vulnerable to manipulation: Marketplaces will often push GMV growth by adding new product or service categories or switching their marketplace in new regions. Whilst this will boost GMV, this dos not necessarily translate into sustainable growth.

To provide a more complete picture of marketplace health, GMV should be complemented with other metrics. Below are some examples of the types of metrics that are important for two-sided marketplaces.

- Unit economics – how is your business doing?

- Match rate – how successfully do the two sides of your marketplace find each other?

- Time to match (inventory turnover) – how long does it take for supply to match with demand?

- Take rate – how valuable is your marketplace?

- User retention cohorts – is your user retention improving?

Note, these are just some examples of the types of metrics you can look at. For a more complete list read our blog on the top marketplace metrics.

Unit economics - how is your business doing?

The main metrics that tell you how your business is doing are cost of goods sold (COGS), contribution margin, cost of acquisition (CAC), customer lifetime value (LTV), LTV/CAC.

As marketplace investors a16z point out, improved network effects usual reveal themselves in marketplace unit economics. For example, network effects should lead to a reduced CAC over time, as the number of organic users should grows. This reduction in marketing spend per new user can be seen in more aged marketplaces like Airbnb, Thumbtack or Instacart.

Match rate - how successfully do the two sides of your marketplace find each other

Marketplaces exist in order to match supply with demand. Therefore it is import to track the rate at which buyers can find sellers i.e. the marketplace “match rate”.

Each marketplace will define their match rate differently. For example, a marketplace for car rentals like Turo may define their match rate to be the percentage of the cars that are currently being rented out vs. empty. By contrast a jobs marketplace like Indeed might define their match rate as the percentage of jobs that get filled on their platform.

A related measure metric might be “zeros”. This is the number of unsuccessful matches. For a car rental marketplace this might be the number of site visitors who fail to find a car to rent or for a jobs board, this could be the number of employers who fail to find an employee on the marketplace.

Time to match (Inventory turnover) - how long does it take to match your marketplace supply with demand?

“Inventory turnover” is reflects how many times inventory is sold over a period of time. For on-demand marketplaces, where matching is done by a centralized algorithm, this is a good measure of “time to match”. Over a longer time span, you should expect a greater amount of the marketplace inventory clears however, higher inventory turnover means that your marketplace is working better.

The inverse of inventory turnover is the “number of days to turn”. This metric tells us the average time that it takes to sell inventory. This metric is more appropriate for traditional marketplaces where sellers must opt-in to the transaction i.e. one side creates a listing and the other responds. Note, an “opt-in” style marketplace is different from an on-demand marketplace like Uber where matching happens according to a centralized algorithm.

For product marketplace like Etsy, the number of days to turn could be how long does it take a seller to sell their product? On a service marketplace like Thumbtack, how long does it take a service provider to get their first quote? On a rental marketplace like Airbnb, how long does it take a property listing to get its first booking?

Take rate - how valuable is your marketplace

As we know by now, the take rate is the percentage of GMV that the marketplace keeps as revenue.

In our article, What is take rate (or commission): Definitive guide, we explain how take rate and GMV are closely related. For instance, a high take rate vs competitors may slow the growth of your marketplace GMV.

All that being said, take rate is ultimately a measure of how much your marketplace participants are willing to pay in order to use your platform to transact. It is therefore a good measure of how valuable your marketplace is, compared to the competitive alternatives.

User retention cohorts - is your user retention improving?

The definition of a marketplace network effects is when the marketplace increases in value as more buyers and sellers join the marketplace. This increase in value should be reflected in user cohorts. Newer cohorts who experience the marketplace when the network is larger, should get more value out of the marketplace. This means that you should see higher user retention for newer cohorts, provided the network is larger at this point.

In reality however, new marketplaces often see declining retention rates by cohorts. This can be an indication that your marketplace is not as valuable as the initial traction might suggest, or there may be other explainations.

For example, one explanation might be that your original cohorts are the early adopters. These users are your “ideal customers” and therefore naturally translate into better retention cohorts. Other reasons might be the addition of a competitor, or that your marketplace network effects are hyperlocal and therefore they will reset when the marketplace is turned on in a new location.

Conclusion: GMV meaning and is it a good metric?

The best way to use GMV is to complement it with other marketplace metrics such as take rate, customer acquisition cost (CAC), cost of goods sold (COGS), contribution margin and so on.

Most marketplace technologies come with a marketplace dashboard for the marketplace operators. These dashboards often include the essential marketplace metrics that you need to track. For example, at Dittofi, all of our open source marketplace templates come with a marketplace dashboard that operators can use to track figures such as GMV, revenue, inventory turnover and so on.

This means that with our marketplace template you not only do you get a fully functional marketplace on day one of your development, but you also get a comprehensive suite of marketplace metrics that can help you monitor the health of your marketplace.

To learn more about how to build a marketplace with Dittofi, check out our marketplace templates or schedule a call with one of our marketplace specialists and learn how you can build an enterprise grade marketplace today!

Become a Marketplace Insider

Join our inner circle for exclusive insights, coveted trade secrets, and unparalleled strategies – your journey to marketplace dominance begins here.