Online marketplaces have reshaped how we buy, sell, and trade goods and services. Whether it’s e-commerce giants like Amazon and eBay, peer-to-peer rental platforms like Airbnb and Turo, or service-based marketplaces like Fiverr and Upwork, these platforms act as intermediaries between buyers and sellers. However, with great convenience comes great responsibility — and that’s where insurance for marketplaces comes in.

While many marketplace founders focus on scaling their platforms, onboarding sellers, and improving user experience, few consider what happens when something goes wrong. A defective product, a data breach, a service gone wrong, or even an injury caused by a rental could lead to legal disputes, financial losses, and reputational damage.

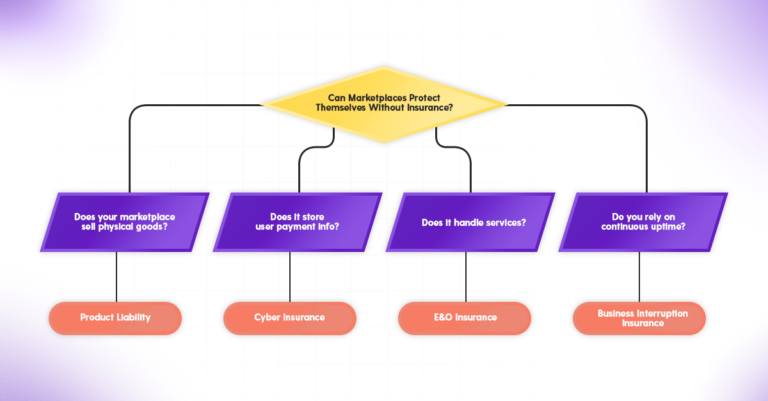

This raises a critical question: Does your marketplace need insurance? The answer isn’t always straightforward. Some marketplaces are legally required to have insurance, while others can operate without it — at their own risk. However, ignoring marketplace insurance could leave businesses vulnerable to lawsuits, financial instability, and loss of user trust.

In this guide, we’ll explore:

– Why marketplaces need insurance

– The different types of insurance available

– Legal requirements for marketplace businesses

– Alternatives to traditional insurance

– How to choose the right coverage for your marketplace

By the end of this article, you’ll understand how to protect your marketplace from unforeseen risks and whether insurance is a must-have or just a safety net for your business.

Why Marketplaces Need Insurance

Marketplaces operate as middlemen between buyers and sellers, but that doesn’t mean they’re free from liability risks. Even if your platform doesn’t own inventory, provide services, or directly interact with transactions, you could still be held responsible if something goes wrong.

Here are some common risks that online marketplaces face:

1. Product Liability & Consumer Safety: Who Takes the Blame?

One of the biggest misconceptions about online marketplaces is that liability for defective or dangerous products lies solely with the seller. However, the reality is that courts have increasingly held platforms accountable for the safety of products sold through their websites.

Imagine a buyer purchases an electronic device from a seller on your marketplace. A few days later, the device overheats and causes a fire, leading to property damage and injury. The buyer sues both the seller and your marketplace, arguing that your platform allowed an unsafe product to be sold.

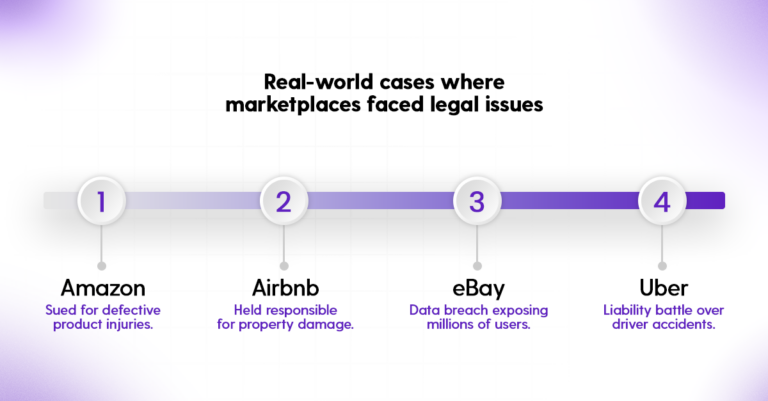

This isn’t just hypothetical — Amazon has been sued multiple times over defective products sold by third-party sellers. Even though Amazon argued that it was merely a facilitator, courts ruled that it shared some responsibility for ensuring product safety. The takeaway? If you operate a marketplace that deals with physical goods, product liability insurance is a necessity, not an option.

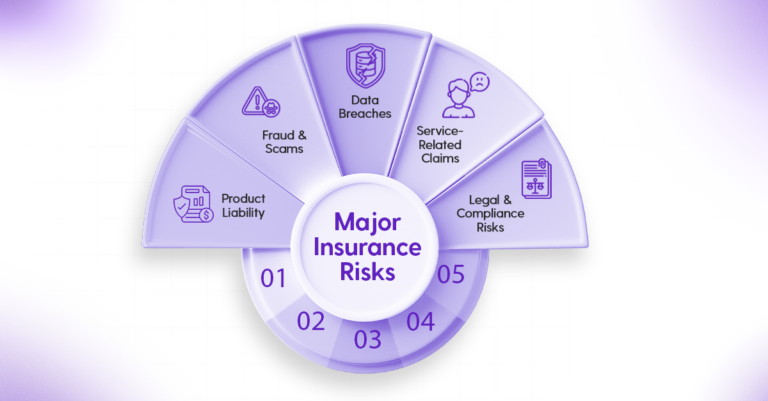

2. Fraud & Scams: The Dark Side of Online Marketplaces

Fraud is an unfortunate reality of the online marketplace industry. While most users engage in legitimate transactions, scammers constantly find new ways to exploit platforms. Common fraud scenarios include:

- Sellers shipping counterfeit, damaged, or incorrect products.

- Buyers falsely claiming an item never arrived to get a refund while keeping the product.

- Account takeovers, where hackers steal credentials and use them to commit fraud.

Without insurance or a strong dispute resolution process, your platform could be forced to absorb the financial losses associated with fraudulent transactions. Marketplaces like eBay and PayPal offer buyer and seller protection policies, acting as an insurance-like safeguard to cover these losses. However, smaller or newer marketplaces often don’t have these built-in protections—leaving them exposed.

3. Data Breaches & Cybersecurity Threats: A Growing Risk

With millions of users’ personal and payment information stored on marketplace platforms, cybersecurity risks have never been higher. Hackers frequently target marketplaces to steal sensitive user data, leading to financial fraud, identity theft, and legal consequences for platforms that fail to protect their users.

Consider the 2014 eBay data breach, where cybercriminals accessed the information of 145 million users. The fallout was severe—customers lost trust, lawsuits were filed, and eBay had to overhaul its security measures to recover.

For any digital marketplace, cyber liability insurance is essential. It covers costs associated with data breaches, legal defense, regulatory fines (under laws like GDPR and CCPA), and even public relations damage control. Without it, a single hack could bring down an entire platform.

4. Service & Experience-Related Claims: When Things Go Wrong

Not all marketplaces deal in physical goods—service-based platforms like Airbnb, Upwork, and TaskRabbit face risks that are just as significant. From botched freelance projects to rental property damage, service marketplaces are vulnerable to claims of negligence, poor service quality, and even physical harm.

For example, Airbnb introduced a $1 million Host Guarantee to protect property owners from damages caused by guests. This coverage reassures hosts that they won’t be financially ruined if a guest accidentally destroys furniture or causes water damage. Without this type of protection, many property owners wouldn’t take the risk of listing on the platform at all.

For gig economy platforms like Fiverr or Upwork, Errors & Omissions (E&O) insurance is crucial. If a freelancer provides incorrect legal advice or a consultant delivers misleading financial projections, clients may sue both the freelancer and the marketplace for damages. E&O insurance helps cover legal fees, settlements, and reputational damage, ensuring that service-based platforms aren’t left vulnerable.

5. Legal & Compliance Risks: Navigating a Complex Landscape

As marketplaces expand globally, they must adhere to local laws and industry regulations. Without proper compliance, platforms risk hefty fines, lawsuits, and even shutdowns. Some key areas of legal risk include:

- Consumer Protection Laws – Many countries hold marketplaces accountable for product safety, misleading advertising, and refund policies. Platforms that fail to comply may face regulatory action.

- Intellectual Property Rights – Selling counterfeit or unauthorized goods (even unknowingly) can lead to lawsuits from major brands and copyright holders.

- Employment Classification – Gig marketplaces like Uber and DoorDash have faced legal battles over worker classification, with regulators arguing that gig workers should be classified as employees rather than independent contractors.

The regulatory landscape is constantly evolving, making it critical for marketplaces to have legal counsel and appropriate insurance coverage to mitigate risks.

Types of Insurance Marketplaces May Need

While every marketplace faces different risks depending on its industry and business model, having the right insurance coverage can protect against financial losses, legal disputes, and reputational damage. Here are the most common types of insurance that marketplaces should consider:

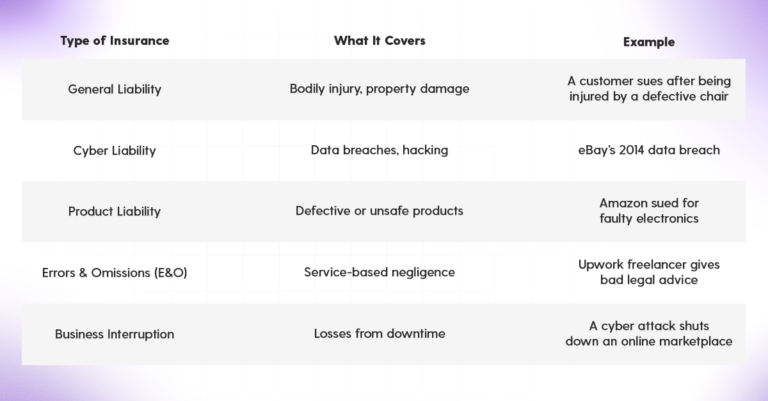

1. General Liability Insurance: The Safety Net for Marketplaces

General liability insurance is one of the most fundamental protections a marketplace can have. It covers claims related to bodily injury, property damage, and third-party liability that might arise due to transactions on the platform.

For instance, imagine a buyer purchases a product through your marketplace and gets injured while using it. Even though your platform didn’t manufacture or sell the product directly, the buyer might still hold your marketplace responsible for facilitating the sale. Without insurance, you could be forced to cover legal fees, settlements, or compensation costs out of pocket.

This type of insurance is particularly crucial for rental marketplaces like Turo or Airbnb, where users interact in person and potential accidents or property damage can lead to liability claims.

2. Product Liability Insurance: Protecting Marketplaces from Defective Products

Marketplaces that allow the sale of physical goods — whether electronics, cosmetics, or apparel—face the risk of defective or dangerous products reaching consumers. Who is liable when something goes wrong — the seller, the manufacturer, or the marketplace itself?

While many platforms operate under the assumption that sellers are solely responsible, some courts have ruled otherwise. Amazon, for example, has been sued multiple times over defective products sold by third-party sellers, with courts arguing that as a marketplace, Amazon has an obligation to ensure product safety.

Product liability insurance helps cover legal defense costs, settlements, and damages in cases where buyers file lawsuits over unsafe or defective products. Without it, marketplaces could find themselves in legal battles that drain resources and damage their reputation.

3. Cyber Liability Insurance: Essential for Digital Marketplaces

In an era where data breaches and cyberattacks are becoming increasingly common, cyber liability insurance is a must for online marketplaces. These platforms handle vast amounts of sensitive user data, including payment details, personal information, and transaction history. A single breach could lead to financial losses, regulatory fines, and a loss of customer trust.

Take eBay’s 2014 data breach, where hackers stole the personal information of 145 million users. The aftermath involved not just legal consequences but also a major hit to customer confidence.

Cyber liability insurance can help cover:

- Legal expenses and regulatory fines related to data breaches.

- Customer notification and credit monitoring costs after an attack.

- PR and crisis management efforts to rebuild marketplace credibility.

For marketplaces like Etsy, eBay, or Airbnb, which store payment and identity verification data, cybersecurity risks are too big to ignore.

4. Errors & Omissions (E&O) Insurance: Protection for Service-Based Marketplaces

Not all marketplaces deal with physical goods. Platforms like Upwork, Fiverr, and TaskRabbit facilitate services, making them vulnerable to claims of negligence, errors, or unsatisfactory work from service providers.

If a freelancer on Upwork delivers faulty work that results in financial losses for a client, the client may sue not just the freelancer but also Upwork itself for facilitating the transaction. This is where Errors & Omissions (E&O) insurance comes in — it helps cover legal costs when marketplaces are accused of misrepresentation, poor service quality, or failure to deliver as promised.

For any marketplace dealing with digital services, professional advice, or skilled labor, E&O insurance provides critical protection against unexpected claims.

5. Business Interruption Insurance: Covering Revenue Losses from Downtime

No marketplace is immune to disruptions. Whether it’s a cyberattack, server failure, legal dispute, or regulatory shutdown, unexpected incidents can force a platform to halt operations, leading to significant revenue loss.

For instance, if a hacking incident shuts down a marketplace for days, sellers lose sales, buyers lose access, and the platform suffers financial losses. Business interruption insurance helps cover lost revenue during downtime, ensuring that the marketplace can recover without severe financial damage.

Marketplaces that rely on continuous uptime—such as stock market-style platforms like StockX or rental marketplaces like Airbnb—can especially benefit from this type of protection.

Are Marketplaces Legally Required to Have Insurance?

Whether an online marketplace needs insurance isn’t a simple yes-or-no answer. The legal requirements vary depending on the industry, the type of transactions facilitated, and the country where the marketplace operates. Some platforms are required by law to carry specific types of insurance, while others choose to forgo coverage — often at their own risk.

Understanding where liability falls in a marketplace transaction is crucial. Is the seller solely responsible if something goes wrong, or can the marketplace itself be held liable? The answer depends on the nature of the platform, local regulations, and how the business is structured. Let’s break it down.

1. Legal Requirements by Industry

Certain industries require marketplaces to carry insurance by law, especially when transactions involve high-risk services, physical goods, or user interactions in real-world environments.

For example:

- Rideshare Marketplaces: Companies like Uber and Lyft must provide insurance coverage for their drivers while they are on duty. Since drivers use personal vehicles for commercial purposes, standard auto insurance doesn’t apply. This led to government-mandated insurance policies that protect passengers, drivers, and third parties.

- Short-Term Rental Platforms: Platforms like Airbnb and Vrbo provide host protection insurance to cover property damage and liability claims. Some cities require short-term rental hosts to carry specific coverage, and Airbnb’s built-in insurance helps ensure compliance.

- E-commerce Marketplaces for High-Risk Products: If a marketplace facilitates the sale of medical devices, hazardous materials, or children’s products, they may be required to ensure liability protection. These regulations exist to protect consumers and ensure that unsafe products don’t make it onto the market.

Why Does This Matter?

If a marketplace operates in a regulated industry, failing to have the proper insurance coverage could result in fines, lawsuits, or even being shut down. Many governments hold platforms responsible for ensuring consumer protection, which means marketplaces must take extra steps to reduce risk.

2. Regional and Country-Specific Laws

Laws around marketplace liability and insurance differ from country to country. Some governments have strict consumer protection laws, while others leave it to the businesses themselves to determine how they handle risk.

- European Union: The Digital Services Act (DSA) places greater responsibility on marketplaces for product safety and liability. Platforms that sell goods or services must ensure consumer protection, making insurance an essential part of compliance.

- United States: The Federal Trade Commission (FTC) enforces consumer protection laws, especially when it comes to misleading claims, fraudulent sellers, and unsafe products. While insurance isn’t always required, marketplaces that operate without coverage may be at higher risk of lawsuits if something goes wrong.

- Canada: Certain provinces require digital platforms to provide liability protection, particularly in industries like real estate rentals and professional services.

- Australia: The Australian Consumer Law (ACL) mandates that marketplaces take reasonable steps to protect buyers from harm, meaning that insurance is often required—especially for platforms that enable physical transactions.

What This Means for Marketplaces

As governments increase oversight of online marketplaces, insurance is becoming more important than ever. Some marketplaces purchase coverage voluntarily as a safeguard, while others must comply with legal mandates to avoid regulatory issues.

3. Can Marketplaces Operate Without Insurance?

In some cases, yes—marketplaces can operate without formal insurance policies, but this comes with risks. Many startups, particularly those in early stages, look for alternatives to traditional insurance coverage to manage liability.

Here’s how some marketplaces attempt to shift liability away from themselves:

- Strict Terms of Service – Some platforms require sellers to assume all responsibility for their products or services. If a dispute arises, the marketplace claims it’s only a facilitator, not a direct seller.

- Buyer and Seller Dispute Resolution – Marketplaces like eBay and PayPal use protection programs instead of traditional insurance. They allow users to file claims for lost, damaged, or fraudulent transactions and then absorb the financial losses internally rather than relying on an external insurer.

- Trust & Safety Teams – Some companies build in-house teams that handle fraud prevention, claims management, and risk assessment, rather than paying for broad insurance coverage.

However, operating without insurance leaves marketplaces vulnerable to legal and financial risks—especially as they scale. A single lawsuit or large-scale fraud event could lead to massive financial losses or even force the business to shut down.

Example: The Cost of Skipping Insurance

Imagine a new peer-to-peer rental marketplace launches without liability coverage. A customer rents an electric scooter through the platform, crashes, and suffers serious injuries. The injured party sues both the scooter owner and the marketplace for failing to ensure safety. Without insurance, the marketplace is left to pay out of pocket — or shut down entirely.

How to Choose the Right Insurance for Your Marketplace

Selecting the right insurance coverage for your marketplace isn’t a one-size-fits-all decision. The risks a platform faces depend on factors such as industry, transaction volume, liability exposure, and budget. A marketplace that facilitates car rentals has very different risks than one that connects freelancers with clients. Understanding these risks is key to choosing the right protection.

Industry-Specific Risks

The type of marketplace you operate plays a crucial role in determining what kind of insurance you need. For instance:

- Product Marketplaces (e.g., Etsy, eBay, Amazon) – These platforms face product liability risks if defective goods cause harm. If a buyer sues after being injured by a product purchased through your marketplace, even if you didn’t manufacture or sell it, your platform could be held partially responsible.

- Rental Marketplaces (e.g., Turo, Airbnb, Getaround) – Marketplaces that facilitate peer-to-peer rentals involve physical property, meaning there’s a higher chance of property damage, accidents, or liability claims. Platforms like Airbnb offer host protection insurance, while Turo provides liability coverage for renters and vehicle owners.

- Service-Based Marketplaces (e.g., Upwork, Fiverr, TaskRabbit) – Since these platforms connect users with freelancers or service providers, they may face errors and omissions (E&O) claims if a client believes they suffered financial losses due to poor service. A business hiring a freelancer through Upwork, for example, may sue the marketplace itself if the work was negligent.

Each type of marketplace faces different risks, so it’s crucial to choose insurance coverage tailored to your business model.

Transaction Volume & Risk Exposure

The size and scale of your marketplace directly impact the likelihood of claims, lawsuits, and disputes. A platform processing thousands of transactions per day is more likely to face legal challenges than a smaller niche marketplace.

High-Volume Marketplaces (e.g., Amazon, eBay, StockX) – Large marketplaces deal with a higher risk of fraud, payment disputes, and regulatory scrutiny. Insurance policies like cyber liability insurance and business interruption insurance become essential to protect against hacking, downtime, and financial losses from system failures.

Emerging Marketplaces & Startups – Smaller marketplaces may be able to operate with minimal coverage in the early stages, prioritizing essential policies like general liability and cyber insurance. However, as the platform scales, so does its exposure to legal and financial risks, requiring more comprehensive protection.

How Much Does Marketplace Insurance Cost?

Insurance costs vary depending on coverage limits, industry risks, and the size of the platform. While large marketplaces may invest in multi-million-dollar insurance policies, smaller platforms can start with basic coverage and scale up as needed.

Here’s a general breakdown of insurance costs for marketplaces:

- General Liability Insurance – Covers injuries, third-party claims, and property damage. Estimated cost: $1,000–$10,000 per year.

- Product Liability Insurance – Protects against defective product claims. Estimated cost: $2,000–$25,000 per year.

- Cyber Liability Insurance – Covers data breaches, hacking, and regulatory fines. Estimated cost: $5,000–$50,000 per year.

- Errors & Omissions (E&O) Insurance – Protects service-based marketplaces from negligence claims. Estimated cost: $1,500–$10,000 per year.

- Business Interruption Insurance – Covers revenue losses from downtime, hacking, or legal issues. Estimated cost: $2,000–$15,000 per year.

The exact cost depends on policy limits, risk exposure, and location, but having even basic coverage can prevent financial disaster in case of an unexpected lawsuit or crisis.

What’s the Best Approach for New Marketplaces?

If you’re just launching your marketplace, it’s important to prioritize essential coverage and expand as the business grows.

- Start with foundational coverage – General liability and cyber liability insurance are the most critical policies for most online marketplaces. These protect against user disputes, fraudulent transactions, and security breaches.

- Assess your liability exposure – If your marketplace deals with physical goods, in-person services, or high-value transactions, additional coverage like product liability or professional liability insurance becomes necessary.

- Work with an expert – Marketplace insurance needs differ from standard business insurance. Consulting with an insurance broker who specializes in online platforms can help you tailor the right protection without overspending.

The Bottom Line: Marketplaces Need Protection to Scale Safely

The success of an online marketplace doesn’t just depend on the number of users or transactions — it depends on how well the platform protects itself and its users from risks. From product liability lawsuits to cyberattacks, fraud, and legal disputes, marketplaces face countless threats that could disrupt operations, damage reputation, or lead to massive financial losses.

While not every marketplace is legally required to have insurance, skipping it altogether is a dangerous gamble. The reality is that even the biggest marketplaces like Amazon, eBay, and Airbnb invest heavily in risk management and insurance policies—and for good reason.

What’s the Next Step?

If you’re looking to launch a marketplace, now is the time to:

– Assess your risk exposure – What type of marketplace are you building?

– Research insurance providers – Compare coverage plans that match your needs.

– Consider hybrid risk management solutions – Insurance + strong platform policies can reduce overall liability.

At the end of the day, marketplaces thrive on trust. Ensuring the safety, security, and financial stability of your platform can make all the difference in long-term success.

Ready to Build a Secure Marketplace?

A scalable, compliant marketplace starts with the right foundation. Learn how insurance can protect your business and keep transactions safe.